How to Buy Land for Investment: A Practical Guide

Ross AmatoShare

When I first set out to invest in land, having a clear roadmap—defining goals, analyzing markets, and securing financing—made all the difference. Understanding each step cuts through confusion and speeds the journey from initial research to closing day.

Quick Guide To Buying Land For Investment

Investing in land offers steady appreciation and a solid way to diversify your portfolio. Breaking the process into manageable phases keeps both first-time buyers and veterans on track.

- Clarify whether you're after long-term growth or immediate rental income

- Weigh different areas based on infrastructure and zoning rules

- Verify title status, access roads, and utility hookups early

- Compare owner-financing deals versus conventional loans

- Sketch out exit scenarios, from resale to lease agreements

Timeline From Research To Closing

Most land deals wrap up in 30–60 days, but knowing your own timeline helps you stay competitive.

- Research markets and narrow down parcels (5–10 days)

- Complete surveys and due diligence checks (7–14 days)

- Lock in financing or seller payment plans (7–14 days)

- Sign contracts and record your deed (5–7 days)

I once added an extra week to double-check a title report, and it saved me from a boundary dispute. That kind of attention can pay off.

Why Follow A Structured Approach

Jumping around between tasks often leads to gaps—missed easements or surprise fees usually show up at the worst moment.

“A clear plan reduces surprises and aligns your purchase with long-term growth targets,” industry veteran Rachel Moore reminds us.

Sticking to a framework means you zero in on properties that fit your risk tolerance and investment goals.

Key Steps Overview

Below is a quick table summarizing the core stages of buying land for investment. Keep it handy as you work through each phase.

| Stage | Purpose | Action Items |

|---|---|---|

| Goals | Align Investments With Objectives | Define budget, timeline, and your risk profile |

| Analysis | Pinpoint Promising Markets | Research growth corridors and zoning regulations |

| Due Diligence | Confirm Legal And Physical Status | Review title reports, surveys, and access rights |

| Financing | Secure Funds On Fair Terms | Compare traditional loans, seller-financing, and down-payment options |

| Exit Planning | Plan For Future Returns Or Leases | Model cash-on-cash yield and potential exit paths |

Use this overview as your compass through each stage.

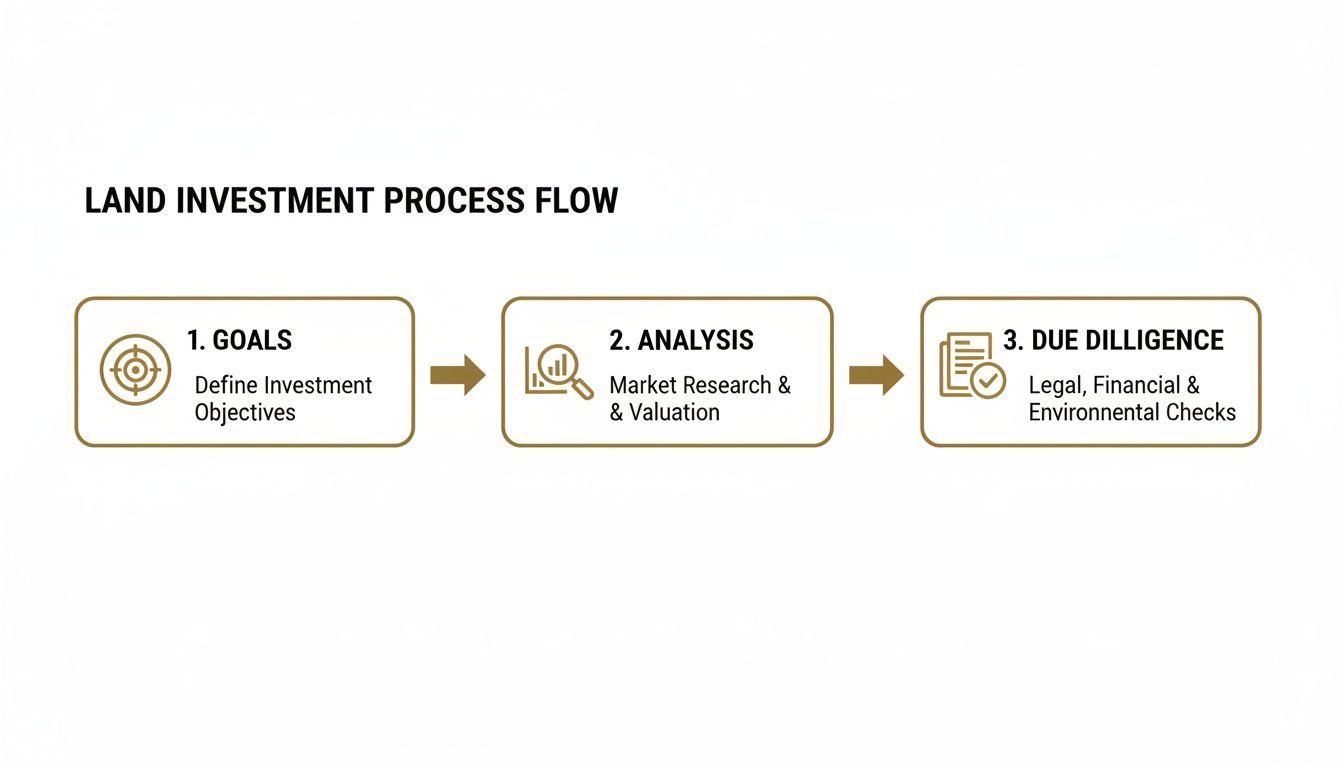

Visualizing The Roadmap

This flowchart shows how solid goal setting naturally leads into market analysis and legal checks.

Common Pitfalls To Avoid

Early mistakes can cost you both time and money. Watch out for these traps:

- Ignoring recorded easements and rights-of-way

- Assuming road access without checking maintenance agreements

- Overlooking annual property tax estimates

- Underestimating utility hookup or development expenses

- Failing to verify flood zone designations

Institutional confidence is back on the rise: 44% of family offices and institutional investors plan to increase their real estate land allocations in 2025, after volumes dipped post-2021. See the details in Knight Frank’s Wealth Report.

Preparation Best Practices

From day one, I kept a spreadsheet to track deadlines, costs, and key notes. Color-coding risk factors—like easements or flood zones—uncovered hidden issues before they became problems.

- Log submission dates for each document

- Note zoning requirements in your target area

- Track utility availability and status of access roads

- Outline your financing strategy in advance

Overview Checkpoint

Before you move on, make sure you’ve covered the essentials:

- Goals are clearly defined with measurable criteria

- Target markets show solid growth indicators

- Title and access rights have been verified

- A financing plan is in place and ready to go

“A simple plan beats complexity every time.”

Keep this checklist within reach. Next, we’ll dive into defining clear investment goals and choosing the right markets.

What This Means for Buyers

Whether you’re a first-time investor or looking to expand your portfolio, following this structured approach provides:

- Clarity on costs, timelines, and legal checkpoints

- Confidence that you’ve uncovered hidden risks before closing

- Efficiency in narrowing down parcels that match your objectives

- Flexibility to compare financing options, including seller-financing through Dollar Land Store, without the friction of bank red tape

For buyers new to raw land, this roadmap demystifies zoning codes, flood zones, and easements. Intermediate investors gain a repeatable process that speeds up future deals. In both cases, you’ll minimize surprises and make data-driven decisions.

Defining Investment Goals And Choosing Markets

Before diving into listings or loan options, you need to know exactly what you’re after. Is this a buy-and-hold play for long-term equity? A quick flip? Or a parcel you can lease out for steady income? Pinning down that purpose up front will keep you from chasing every “hot” market that pops up.

Most land investors fall into one of three camps:

- Long Term Growth – Hold for years, banking on steady appreciation.

- Short Term Flips – Buy underpriced lots and resell within 12 to 24 months.

- Lease Income – Rent to farmers or recreational users for a predictable cash flow.

Your budget and timeline refine the search. A $10,000 to $30,000 price tag usually points you at modest rural tracts. A two-year hold looks very different from a decade-long strategy, and knowing how much uncertainty you can tolerate helps when zoning hiccups or weather delays creep in.

Clarify Your Investment Objectives

Sum up your top goal in one sentence. Then test it against your budget, timeline and appetite for risk. Doing this prevents “paralysis by analysis” and forces real-world discipline.

I once planned my purchase around a state highway project. Because I synced my exit with construction milestones, my land went from “paper asset” to “active resale” on schedule.

| Budget Range | Timeline | Risk Profile |

|---|---|---|

| $5k–$20k | 1–2 years | Low to Medium |

| $20k–$50k | 3–5 years | Medium |

| $50k+ | 5+ years | High |

Drop this matrix into a spreadsheet or mapping tool and filter out everything that doesn’t match. It’s astonishing how many listings you can eliminate in mere minutes.

Assess Market Trends

Local planning documents and zoning updates often reveal the next growth hotspots. A new sewer line here, a proposed transit spur there—those clues can tip you off to undervalued land.

On the global side, Nuveen notes private real estate values rose for five straight quarters through Q2 2025, with $739 billion in transactions—a 19% year-over-year gain.

“Tracking infrastructure plans before buying land gives you a head start on value creation.”

Watching parcel rezoning proposals or overlay amendments can uncover gems before the market adjusts.

Match Suitable Regions To Goals

Not every region fits every strategy. If you’re chasing lease revenue, agricultural belts with reliable tenant demand make sense. Flippers, by contrast, often target suburban fringe zones slated for rapid development.

For example, a 20-acre plot in Kansas at $50 per acre can generate $1,000 a year in lease income—enough to cover taxes and minimal upkeep.

- Proximity to planned roads or utilities accelerates appreciation.

- Zoning updates shape permitted uses and exit options.

- Utility access drives your development-cost estimates.

And don’t overlook the power of a drive-by. Road conditions, cell coverage and signs posted on-site often tell a story no map layer can.

Leverage Local Data And Field Visits

Blend digital research with on-the-ground checks. County GIS portals and assessor records reveal parcel lines, flood zones and recent sales. Planning commission minutes flag rezoning votes and infrastructure plans long before press releases hit.

- GIS maps display boundaries, topography and flood overlays.

- Planning agendas detail upcoming zoning and utility expansions.

- Tax assessor files highlight undervalued sales or homestead exemptions.

Talking to neighbors about road upkeep or community projects validates what the public record shows. Combining clear objectives with hands-on due diligence is the recipe for confident, well-timed land investments.

Conducting Due Diligence And Legal Checks

When you’re about to buy land, due diligence is your best defense against nasty surprises at closing. It’s about understanding every rule, easement and title detail before you put pen to paper.

Real-world pitfalls often trace back to a missed zoning restriction or hidden easement. That’s why you should review all documents thoroughly before making an offer.

Checking Title And Liens

Digging into the title report shows who’s owned the property and flags any liens. You’ll usually secure this through a title company or the county clerk’s office.

Finding a tax lien early shields you from unexpected debt. Expect to pay around $200 to $500 for a standard title search.

- Cross–reference seller names against county records

- Spot outstanding mortgages, judgments or easements

- Confirm there are no unpaid taxes or special assessments

Reviewing Easements And Access Rights

Easements can shape how you use your land, whether it’s a gas pipeline running underneath or a shared driveway.

| Easement Type | Description | Next Step |

|---|---|---|

| Utility Corridor | Cable and power lines | Obtain utility company clearance |

| Public Right-Of-Way | Access for roads or trails | Check maintenance and ownership docs |

| Pipeline Easement | Underground fuel or water pipelines | Review engineering maps |

If you skip this, you might find out later that you can’t build where you planned.

Interpreting Zoning And Land Use Rules

Each county sets its own zoning codes, and they matter. They dictate building heights, lot sizes and permitted activities.

- Use the county GIS portal to view zoning maps and ordinances

- Note permitted, conditional and accessory uses

- Verify setback requirements, density rules and minimum lot dimensions

Ordering Surveys And Boundary Verification

A boundary survey nails down your exact parcel lines. Without it, you risk trespassing or disputes.

Case Study

A buyer in California discovered a neighbor’s shed sitting 15 feet onto their new lot. The fix? A boundary survey at $1,200 plus legal fees—hard lesson learned.

- Hire a licensed surveyor familiar with local terrain

- Confirm corner markers and boundary stakes

- Check road access and who’s responsible for upkeep

Assessing Environmental And Site Risks

Environmental checks uncover wetlands, contamination or other issues that could derail your plans. A Phase I environmental assessment typically costs $1,500 to $3,000.

Early environmental inspections save you from expensive cleanup and project delays.

- Wetland delineation or floodplain status

- Soil tests for contaminants or underground tanks

- Investigation into protected species or historic site restrictions

Collaborating With Local Experts

You don’t have to go it alone. County planning staff and local land attorneys can translate dense legalese into plain English.

- Talk to planning officials about upcoming zoning changes

- Hire a real estate attorney for contract contingencies

- Work with local surveyors for precise boundary verification

Often, these experts know about road improvements or utility extensions before they hit public records.

You might be interested in our article on what to look for when buying land.

Check out our guide on What To Look For When Buying Land

Verifying Utility Access And Road Maintenance

Don’t assume utilities and roads are in place—you need confirmation.

- Review county road department docs for maintenance schedules

- Ask the seller about shared drive agreements or HOA rules

- Determine if private roads need special permits or extra insurance

Dollar Land Store’s help center includes free templates and checklists to keep your due diligence on track.

Key Takeaways

- Early title and lien checks reduce last-minute setbacks

- A detailed survey prevents boundary disputes

- Environmental assessments help you avoid costly cleanup

Exploring Financing Options And Payment Plans

Finding the right path to fund raw land can feel like piecing together a puzzle. Traditional home mortgages seldom apply, so you’ll need to explore multiple avenues. Below, we dive into bank and government loans side by side with owner-financing deals—complete with amortization snapshots, balloon-payment examples, and negotiation tactics designed to safeguard your cash flow.

Bank Loans And Government Programs

Banks typically expect a 20% down payment and offer terms ranging from 5 to 20 years. Interest rates sit between 6% and 9%, depending on your credit score and the parcel’s characteristics.

Meanwhile, USDA loans let qualified buyers skip down payments altogether, stretching repayments out to 33 years in eligible rural zones. FHA’s Section 203(k) program sometimes applies when you plan improvements, requiring just 3.5% down.

-

Bank Land Loan

Typical rate: 6%–9%

Down payment: 20% -

USDA Rural Loan

Down payment: 0%

Term: Up to 33 years -

FHA Section 203(k)

Down payment: 3.5%

Restricted to improvements

This side-by-side comparison helps you match each option to your cash reserves and timeline.

Owner Financing Options

When you deal directly with a seller, credit checks often vanish. Some agreements start at $1 down, plus routine document fees. Others ask for 5%–10% up front, then roll into a monthly plan.

You can negotiate clauses that cap interest hikes or even carve out a brief payment holiday each year.

Direct owner financing can shrink barriers and fast-track your purchase process.

Quick Negotiation Tips

- Cap interest rates to a national index (for example, the prime rate).

- Ask for a six-month payment pause if you hit a cash crunch.

- Insist on a full amortization schedule rather than a single balloon payment.

You might be interested in our guide on How seller financing paves the road to land ownership for you.

Comparing Amortization And Balloon Structures

| Feature | Amortization Plan | Balloon Payment Example |

|---|---|---|

| Term | 15 years | 5 years + Lump Sum |

| Monthly Payment | Fixed principal & interest | Lower principal then interest |

| Final Lump Sum Due | None | 80% of principal |

| Cash Flow Impact | Steady schedule | Small early payments, spike later |

A level-pay setup delivers predictability. Balloon structures lower initial outlays but demand a big payment down the road. Your choice hinges on when you’ll sell, refinance or tap other resources.

How To Evaluate Payment Plans

Align your loan length with how long you plan to hold the land. A shorter term slashes total interest but boosts monthly bills. Stretching the term eases each payment at the cost of extra interest over time.

- Run numbers through online calculators (e.g., Bankrate or Mortgage Calculator).

- Explore refinancing after a few years to lock in better rates.

- Don’t forget closing fees, interest deductions and annual property taxes.

Document fees typically land between $150 and $500, so build those into your model. With solid figures in hand, you’ll negotiate from a position of strength.

Real World Finance Scenario

Picture this: you find a four-acre parcel tagged at $20,000 with owner financing. The seller agrees to 10% down ($2,000) at 7% interest, amortized over 10 years. Your monthly payment clocks in around $218, combining principal and interest.

After a decade you’ve paid roughly $26,160, including about $6,160 in interest. If you add a balloon at year five, your monthly drops but you’ll owe a lump sum later.

-

Balloon Example:

$150 per month, with $17,500 due at the 5-year mark

Such a structure can line up with a refinance or future sale. Always comb through the amortization schedule for prepayment penalties. Get any payment-holiday agreements in writing. Then, keep your budget updated—no surprises when bills arrive.

By breaking down each option and running real scenarios, you’ll walk into negotiations clear-headed and prepared. That’s how you secure terms that dovetail with your financial goals—and move confidently toward closing.

Estimating Returns And Planning Exit Strategies

Turning raw acreage into profit starts with realistic projections and a solid exit roadmap. I’ve seen investors stumble without clear metrics, so I always begin by breaking down cash-on-cash yield, cap rate, and IRR. These numbers tell you when and how you’ll see gains in hand.

Calculating Cash On Cash Yield

Cash-on-cash yield measures annual net income against the cash you actually invested. It’s a straightforward way to see your money working.

- Net Operating Income (NOI): Estimate lease proceeds, then subtract property taxes, insurance, and upkeep.

- Cash Outlay: Add up your down payment, closing fees, and any initial improvements.

- Real-World Example: Leasing a parcel for $1,000 a year on a $20,000 purchase with $3,000 in upfront costs gives you about 4% cash-on-cash.

Evaluating Cap Rate And IRR

Cap rate and IRR are like a dynamic duo for land deals. Cap rate shows the immediate yield, while IRR tells the story of every dollar in and out over time.

- Cap Rate: Divide your NOI by the current market value of the land.

- IRR: Find the discount rate that brings your net present value to zero across all cash flows, including your final sale.

Putting these side by side helps you choose between a long-term hold or a quick flip.

Comparing Lease Income To Flip Profits

Leasing can cushion your carry costs while you wait, whereas flipping aims for one big payoff. Here’s how they stack up on a 20-acre tract at $50 per acre:

Leasing Model

- Annual Income: $1,000 (20 acres × $50)

- Carrying Costs: $400 in taxes and fees

- Net Cash Flow: $600 per year

Development Flip

- Estimated Sale Price: $25,000, based on nearby comps

- Upfront Costs: $4,000 survey, $2,000 permits, $1,000 selling fees

- Gross Profit: $18,000 before taxes

In 2025, investor demand is shifting toward industrial sites, data-center land, and mixed-use tracts—driven by economic shifts and new technologies. Transaction volumes dipped in 2024, but lower rates are closing bid-ask gaps. Read the full findings in MSCI’s Real Estate in Focus report.

Planning Your Exit Strategy

Timing your sale around market cycles and personal goals can make or break a deal. If carrying costs stay low, riding out a downturn might pay off. Or you can time a sale when comps hit their peak.

- Consider a 1031 exchange to defer capital gains

- Form a joint venture for development projects to spread risk

“Choosing an exit path in advance keeps you aligned with benchmarks and avoids reactive selling,” advises land strategist Tom Jensen.

By laying out cash-on-cash yield, cap rate, and IRR, you’ll have a clear lens for weighing exit options. Whether you lean into leasing or plan a development flip, matching the strategy to your financial targets is key.

Evaluating Alternative Exits

Sometimes, the best strategy is the one you haven’t thought of yet. Here are a few ways to pivot if the market surprises you:

- 1031 Exchange: Swap into a similar property and defer taxes

- Partnerships: Team up with a developer to split costs and expertise

- Conservation Easement: Donate land for tax deductions and positive community impact

Mapping these paths against your goals keeps you nimble. I always review projections annually against real market data—and I recommend you do the same. Consider consulting a tax advisor early so you’re ready when it’s time to pull the trigger.

Why Consider Dollar Land Store?

If you’ve been eyeing land as an investment but balk at hefty down payments and bank red tape, Dollar Land Store is designed with you in mind. We’ve stripped away the usual hurdles—no credit checks, no hidden approvals, and certainly no surprise fees.

Our model invites both first-timers and seasoned investors to start small and build big.

- Affordable parcels starting at $199

- Owner-finance options with just $1 down plus document fees

- Zero agent commissions or credit reviews

- Rapid contract setup backed by a title guarantee

Transparent Finance And Clear Terms

Owner financing is the centerpiece here—it replaces bank mortgages with a straightforward contract you can read in minutes. Every agreement clearly states the interest rate, term length, and payment schedule before you ever sign.

- No hidden fees—you see the full fee breakdown up front

- Document preparation handled online within hours

“Dollar Land Store lets you focus on growth instead of paperwork.”

Multi State Inventory And Speed

Hunting for the right parcel? Browse thousands of rural properties in 7 states, from California’s high deserts to Oregon’s forest edges. We cut out middlemen so you interact directly with our land experts.

| Feature | Traditional Broker | Dollar Land Store |

|---|---|---|

| Entry Cost | $10k+ | $199 |

| Down Payment | 10%–20% | $1 plus fees |

| Approval Time | 30–60 days | 24–48 hours |

| Fees | Agent commissions | Transparent flat fee |

How To Buy Land For Investment With DLS

Navigating the process is surprisingly simple. First, head to our interactive map and filter by state, price, or acreage. Then you’re ready to move fast:

- Place your $1 down reservation online to hold the parcel

- Review and sign your owner-finance agreement electronically

- Finalize closing in 24–48 hours and receive a clear title

All document fees appear before you commit, so there are no surprises. And if questions pop up, our help center and dedicated support team are just a call or click away.

“Simple terms let you focus on land, not paperwork.”

Whether you’re chasing long-term appreciation or planning a rental retreat, we’ve got the tools and inventory to match your goals.

- Browse available land at DollarLandStore.com

- Reach out to our team for tips on evaluating parcels

- Explore every owner-finance plan and calculate your monthly payments

Best Practices When Working With DLS

We recommend starting each search by reviewing zoning, access, and parcel size directly on our property pages. Comparison filters are your friend when you’re juggling budget and location preferences.

- Check GIS maps linked in every listing

- Confirm zoning requirements on county websites

- Arrange a site visit before you finalize

Partnering with DLS means bypassing hidden costs and slow timelines that plague traditional land deals. With over a decade in the business and hundreds of clients who’ve successfully closed, our process is proven.

Get started today and streamline the way you buy land for investment.

Buyer Next Steps And Key Takeaways

With the roadmap in hand, you're set to drill down on your ideal parcel. Define your budget, holding timeline, and acceptable risk level—all before you dive into listings.

- Run a title and zoning search in your target county.

- Collect at least three financing quotes, eyeing both owner-finance and traditional loan terms.

- Feed those figures into your return model to compare cash-on-cash yields, cap rates, and exit scenarios.

Keep the due diligence checklist handy. It’s your go-to for title quirks, access routes, and utility hookups.

“Consistency in early checks avoids surprises at closing,” land expert Rachel Moore notes.

Try a mock online due diligence search to spot any gaps. Then, chart exit options—lease income, flips, or exchanges—in a simple table.

Planning Your Actions

- Review owner-finance terms closely, especially interest caps and prepayment fees.

- Plan a site visit to assess road conditions and cell coverage firsthand.

- Pull recent comparables from local listings to sharpen your projections.

Maintain a living spreadsheet. Jot down every assumption, then update it with real-world quotes and site data.

When you’re ready, head to DollarLandStore.com to browse parcels and owner-finance deals. Reach out to our team with any questions before closing.

Conclusion

Buying raw land for investment doesn’t have to be daunting. By defining clear goals, conducting thorough due diligence, evaluating financing options, and planning exit strategies, you’ll move forward with confidence. Remember, transparent owner-financing through Dollar Land Store can simplify every step—no credit checks, low entry costs, and quick approvals. Whether you’re a first-time buyer or an experienced investor, this guide equips you with the tools to secure your ideal parcel and maximize returns.

Browse available land at DollarLandStore.com.

Explore seller-financed land options through Dollar Land Store.

Contact Dollar Land Store with questions about buying raw land.