How to Buy Land Without a Realtor: A Practical Guide

Ross AmatoShare

Buying land without a realtor is a path that puts you in direct control of the search, due diligence, and negotiation. For buyers comfortable with research, particularly those interested in affordable rural land, this approach can save money on commissions and simplify communication with sellers. However, it also means you are responsible for every step of the process.

This guide is for buyers of vacant, raw land who want to manage the purchase themselves. It covers how to find properties, what research is critical, and how to navigate financing outside of traditional banks. We will not be covering complex commercial real estate or properties with existing homes. The focus is on the straightforward purchase of a piece of land.

Why You Might Buy Land Without a Realtor

Going it alone isn’t for everyone. But for the right buyer—someone who is diligent and looking for a simple, affordable parcel—it is an excellent option. You gain a level of control and potential savings that is not possible when an agent is involved.

The Core Motivations for a Direct Purchase

Most people who skip a realtor do so for a few key reasons, with cost savings being the most common. By not using a buyer's agent, you avoid their commission, which is often 2.5-3% of the sale price. While this is a significant saving, remember you will still have other closing costs.

Beyond savings, other powerful motivators include:

- Direct Communication: Speaking directly with the seller eliminates miscommunication. You can ask specific questions about the property’s history, access, or unique features and get an immediate, direct answer.

- Access to More Listings: This path opens up a large inventory of for-sale-by-owner (FSBO) properties. Many land sellers, especially those with smaller rural parcels, do not use the Multiple Listing Service (MLS), meaning you find land most other buyers never see.

- Greater Control and Flexibility: You manage the timeline, negotiation strategy, and closing process. This is a major benefit for buyers interested in non-traditional arrangements, like the seller financing options we offer at Dollar Land Store.

A Common Buyer Misconception: Many believe a realtor's main job is just finding properties. In reality, a good agent also acts as a project manager, coordinating inspections, navigating contracts, and ensuring deadlines are met. When you buy direct, you take on that project manager role.

While the benefits are clear, this path demands thorough due diligence. You are solely responsible for verifying every detail, from ensuring the title is clear to understanding specific county zoning rules, like those in Mohave County, AZ. This guide is designed to provide the knowledge you need to handle that responsibility with confidence.

How to Find and Evaluate Land Listings on Your Own

Once you decide to buy land without a realtor, the search begins. This process is about looking beyond the standard MLS listings that agents use to uncover opportunities others miss. Modern online tools have made this independent search more accessible than ever.

The landscape for property searches has shifted. Today, approximately 50–51% of buyers begin their search online, while only about 29% start with a real estate agent. This trend shows a growing comfort among buyers in taking the lead.

Where to Find Off-Market and Direct Land Deals

To find the best parcels, you must look where agents typically do not. Many individual sellers and specialized land companies never list on the MLS, so limiting your search there means missing a significant portion of the market.

Focus your search across a few key platforms:

- Specialized Land Websites: Start with major platforms like LandWatch, Land.com, and Lands of America. These sites are designed for land buyers, with filters for state, county, acreage, and price. They are the primary hubs for raw land.

- For-Sale-By-Owner (FSBO) Sites: These can be excellent sources for direct-from-seller deals. You'll often find unique properties, like this plot of land for sale in Liphook, listed by owners who prefer to manage the sale themselves.

- County Websites: This is a more advanced strategy. Check the county assessor or treasurer’s website for tax sale properties. You can find land at a significant discount, but be prepared for extensive due diligence to ensure the title is clear.

How to Analyze a Land Listing

Finding a listing is the first step; evaluating its quality is the critical part. A vague or incomplete listing is a major red flag. It may signal an uninformed seller or an attempt to hide a problem. Pay close attention to both what is said and what is left out.

Pro Tip: If a listing lacks a specific address or, more importantly, an Assessor's Parcel Number (APN), proceed with extreme caution. The APN is the unique identifier for the property. Without it, you cannot conduct proper research.

As you review listings, demand clear answers on these essential points:

- Access: Does the property have direct, legal frontage on a public or private road? Phrases like "access nearby" are warning signs that the property may be landlocked.

- Utilities: Are water, sewer, and electricity available at the property line? If not, you must budget for the cost of a well, septic system, and potentially solar power. These expenses can be substantial. For example, the real cost to clear land before development can add thousands to your budget.

- Zoning: The listing should specify the zoning classification (e.g., Residential, Agricultural). If it just says "unrestricted," do not take it at face value. You must call the county to confirm exactly what that means.

- Photos and Maps: A trustworthy seller will provide clear, recent photos from multiple angles and detailed maps. Be skeptical of listings with only blurry images or a generic satellite view.

Realtor-Led vs. Direct Land Purchase: A Task Comparison

This table illustrates how responsibilities shift when you choose to buy land on your own versus using a traditional real estate agent.

| Task | Handled by in a Realtor-Led Purchase | Handled by in a Direct Purchase |

|---|---|---|

| Finding Listings | Realtor (primarily from the MLS) | You (using online platforms, county records) |

| Initial Due Diligence | Realtor (basic property details) | You (verifying access, zoning, utilities) |

| Negotiating Price/Terms | Realtor (acts as an intermediary) | You (direct negotiation with the seller) |

| Drafting the Offer | Realtor (using standard forms) | You or an attorney |

| Managing Escrow | Realtor and title company coordinate | You and the title/escrow company |

| Clearing Title | Title company (overseen by Realtor) | Title company (overseen by you) |

| Coordinating Closing | Realtor schedules and manages closing | You schedule and manage closing |

As shown, buying direct places you in charge of the entire process. It requires more hands-on work but provides complete control from start to finish.

Your Critical Due Diligence Checklist for Land

This is the most important phase of buying land without a realtor. As your own investigator, you must be meticulous. Skipping due diligence is how buyers end up with property they cannot access, build on, or legally own.

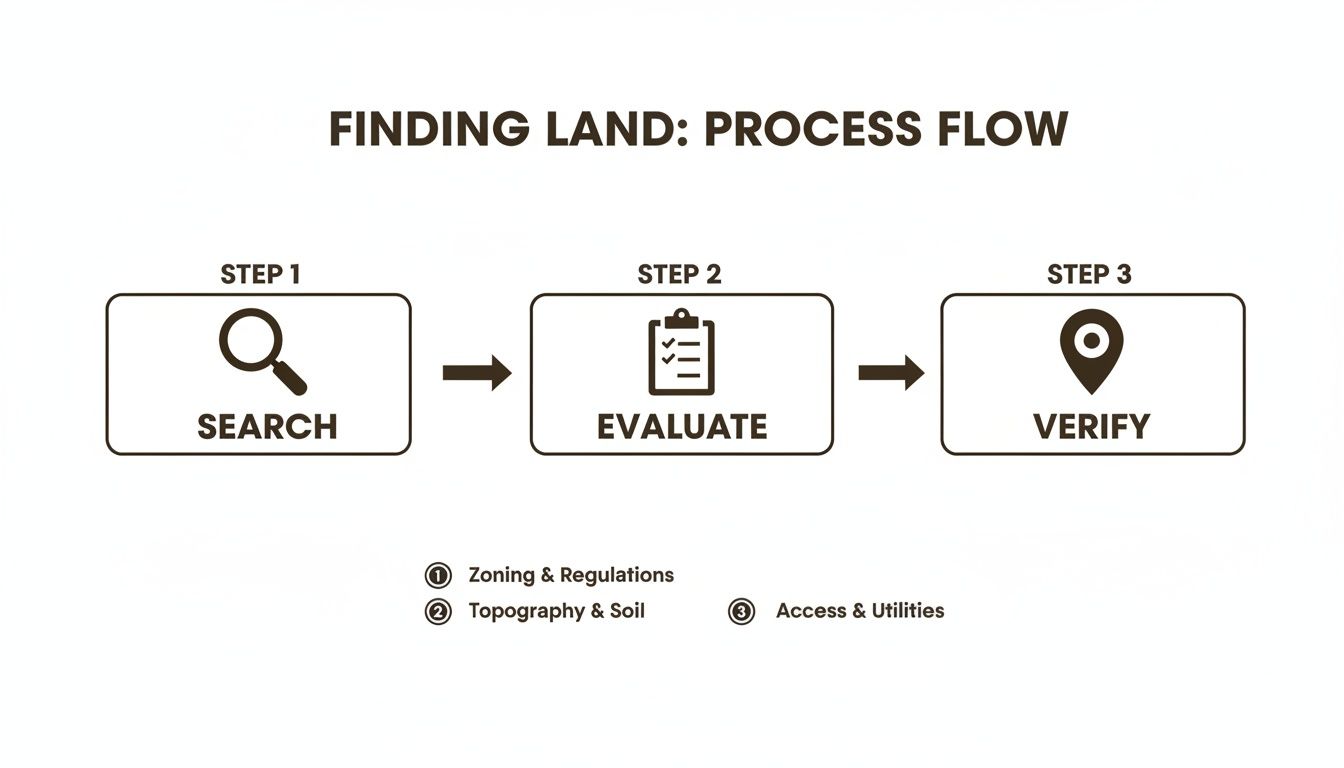

Your research should focus on three areas: legal status, physical characteristics, and local regulations. Getting all three right is essential to protect your investment.

Legal and Title Verification

Before you get attached to a property, you must confirm who legally owns it and if any other parties have claims on it. This process revolves around the property’s title. A "clear title" means the seller has the undisputed right to sell it.

The main issues to look for are liens and encumbrances. A lien is a legal claim against the property for an unpaid debt, such as property taxes. An encumbrance is a broader term for claims like an easement, which might grant a utility company or a neighbor the right to cross your land.

Your action plan:

- Hire a Title Company or Real Estate Attorney. This is not a step to skip. A professional title search is worth the cost, as experts can uncover issues in public records that you would likely miss.

- Get a Preliminary Title Report. This report summarizes the findings of the title search. It identifies the legal owner, provides the official property description, and lists any liens or easements.

Insight Buyers Often Miss: Do not just skim the title report. Read every single exception listed. A "minor" utility easement might run directly through the only suitable building site, making your plans for the property unfeasible.

Physical and Access Assessment

Once you confirm the title is clear, you must evaluate the land itself. This goes far beyond the listing photos. You need to understand the topography, assess potential risks, and, most importantly, confirm how you will get to your property.

You can begin this research from home. Google Earth Pro is a valuable tool for viewing topography, while FEMA flood maps can identify if the property is in a high-risk flood zone.

However, the single most critical physical check is for access. There are two types, and you must have both:

- Physical Access: Is there an actual, drivable road leading to the property? A line on a map is meaningless if it leads to an impassable gully.

- Legal Access: Do you have the legal right to use that road? If the only path crosses a neighbor’s property and no recorded easement exists, they could block access at any time, leaving you landlocked.

Zoning and Land Use Investigation

The final step is to determine what you are legally allowed to do with the property. County and municipal regulations govern all land use. Never rely solely on a seller's claims, especially vague terms like "unrestricted."

Common Buyer Misconception: Many buyers assume "unrestricted" means "no rules." This is almost never the case. It usually just means there is no Homeowners Association (HOA). You are still subject to county zoning ordinances, building codes, and health department regulations for things like septic systems.

Your final essential task is to call the county planning and zoning department. Have the Assessor’s Parcel Number (APN) ready and ask direct questions:

- What is the official zoning for this parcel?

- Is there a minimum acreage requirement to build a residence?

- Can I live in an RV on the property, and if so, for how long?

- What is the process for obtaining well and septic permits?

Thoroughly completing these checks is the best way to protect your investment and ensure the land you buy meets your needs. For a more detailed checklist, see our guide on what to look for when buying land.

Structuring Your Offer and Navigating Financing Options

After completing your due diligence and finding a suitable property, it is time to make a formal offer. This should be a clear, written proposal, not a verbal agreement. As you are acting without a realtor, you will be responsible for drafting this important document.

A well-structured offer protects both you and the seller by leaving no room for misunderstanding. It must clearly state the purchase price, the proposed closing date, and any conditions that must be met for the sale to proceed. These conditions, known as contingencies, are your primary protection. For example, a contingency for a successful percolation (perc) test allows you to withdraw the offer if the soil cannot support a septic system.

The Challenge of Traditional Financing for Land

A common obstacle for first-time land buyers is that most traditional banks are reluctant to finance raw land. From a lender's perspective, vacant land is a higher-risk investment because it lacks a structure (like a house) to serve as immediate collateral. This makes securing a conventional loan difficult. This financing challenge is a primary reason why direct-to-seller transactions, especially those offering owner financing, are so prevalent in the land market.

Understanding Seller Financing

Seller financing (also known as owner financing) is an arrangement where you make payments directly to the property owner instead of a bank. It is a common, legal, and effective way to purchase land.

The process typically works as follows:

- Down Payment: You and the seller agree on an initial down payment.

- Payment Plan: The remaining balance is paid in monthly installments over an agreed-upon term and interest rate.

- Agreement for Sale: The terms are formalized in a legal contract, sometimes called a Land Contract or Agreement for Sale. This document specifies all details, including who is responsible for property taxes.

- Title Transfer: The seller retains legal title to the property as security. Once the final payment is made, the title is transferred to you.

The primary benefit of seller financing is its flexibility. You are not bound by a bank's rigid underwriting criteria. Instead, you can negotiate directly with the seller to create a payment structure that fits your budget.

This method is particularly well-suited for affordable, rural land where the purchase price may be too low for a traditional mortgage.

What Your Offer Should Include

When drafting your offer, clarity is essential. A simple, well-organized document shows you are a serious and prepared buyer.

| Component | What to Include | Why It's Important |

|---|---|---|

| Price | The exact dollar amount you are offering. | This is the most fundamental term of the deal. |

| Timeline | Your desired closing date (e.g., 30 or 45 days). | Sets expectations for how quickly the sale will be finalized. |

| Contingencies | Any conditions like a perc test or survey. | Protects you from buying a property with unforeseen problems. |

| Financing | Specify cash or seller-financing terms. | Informs the seller how you intend to pay for the property. |

Remember, a major motivation for buying direct is to avoid high commissions. With agent fees often totaling 5–6%, a direct purchase can result in thousands of dollars in savings. You can learn more about how commission structures impact real estate deals to better understand the costs you are avoiding.

Risks & Limitations: What Can Go Wrong

Buying land without a realtor can be a cost-effective and empowering process, but it is essential to understand the associated risks. Taking on full responsibility for the transaction means you are also accountable for any mistakes. A clear understanding of potential pitfalls is the best way to avoid them.

Financial and Legal Vulnerabilities

The most significant risks are financial and legal. Without a professional market analysis, it is easy to overpay. A good agent uses comparable sales data ("comps") to ensure an offer is aligned with market value. When you are on your own, you must rely on your own research, which may be incomplete.

Even more serious are the legal issues that can affect a property. A title search may uncover an old lien, an easement that restricts your building plans, or a clouded ownership history. A common but devastating discovery is the lack of legal road access, which can render a parcel nearly worthless.

A Realistic Scenario: A buyer finds an appealing 10-acre parcel in rural Colorado. To save money, they skip a professional survey, relying instead on an old fence line as the boundary. After closing, they discover the fence is 30 feet inside the neighbor’s property. The land they purchased is significantly smaller than they believed, and they now face a potential legal dispute.

Budgeting for Professional Services is Non-Negotiable

While you are saving on an agent's commission, you must reallocate a portion of those funds to hire other essential professionals. The goal is not to do everything yourself but to manage the process and bring in experts for critical tasks.

Your budget should include:

- A Title Search: A title company or real estate attorney must verify that the title is clear and transferable.

- A Property Survey: A licensed surveyor can officially mark your property boundaries and identify any encroachments or unrecorded easements. This can cost from $500 to over $2,000, depending on the property's size and complexity.

- A Legal Review: Having a real estate attorney review your purchase agreement is a wise investment, especially in a seller-financed transaction. You can learn more about the cost-risk tradeoffs of buying without an agent from industry analysis.

When This Approach Is Not Appropriate

Buying directly from a seller is most effective for simple transactions involving affordable, vacant land. It is not suitable for all situations.

You should hire a professional agent if you are considering:

- High-Value or Commercial Properties: These involve complex zoning, financing, and legal issues that require specialized expertise.

- Properties with Known Disputes: If a property has existing environmental issues, boundary conflicts, or other legal entanglements, you need an experienced advocate.

- Buyers with Limited Time or Experience: If you cannot commit the necessary time for thorough due diligence, the risks of going it alone outweigh the potential savings.

Success in a direct purchase depends on your willingness to do the research, your honesty about what you do and do not know, and your judgment to hire experts when needed.

The Dollar Land Store Context: A Structured Approach

When you choose to buy land without a realtor, you need a process that is clear and reliable. At Dollar Land Store, we have designed our entire business model to provide a transparent and structured path to land ownership.

Our approach is straightforward: we own every property we sell. This means we have already completed the initial due diligence to secure a clear title before the property is ever listed. This removes one of the most significant risks and uncertainties you would face when buying from an individual seller.

Our Seller Financing Structure

A major obstacle for land buyers is securing a loan for a vacant parcel. We address this by offering our own in-house seller financing. This is a direct agreement between you and Dollar Land Store, not a complex arrangement involving third-party lenders.

We use a legal document called an Agreement for Sale. This contract clearly outlines your entire payment plan: the down payment, the fixed monthly payment, and the loan term. It is a simple, dependable alternative to traditional bank financing, designed to make land ownership accessible.

At Dollar Land Store, our purpose is to provide a structured, transparent, and responsible way to buy land. We believe clarity is the foundation of a successful direct purchase.

Buyer Responsibilities and Our Rules

A transparent transaction requires that you understand your obligations from the beginning. Our rules are in place to protect both you as the buyer and our ability to continue offering affordable terms. We are always upfront about these responsibilities.

Key buyer responsibilities include:

- Property Taxes: While making payments under the Agreement for Sale, you are responsible for paying the annual property taxes directly to the county.

- No Refunds: All sales are final. We strongly encourage you to perform all your due diligence and ask any questions before signing the purchase agreement.

- Land Use Before Payoff: You may not live on the property or make any permanent improvements (such as building a structure or installing a septic system) until the contract is paid in full and the deed is transferred into your name.

Our process is built to provide you with the information and structure needed to buy land with confidence.

At Dollar Land Store, we’ve built our entire process around being clear, straightforward, and ready to answer your questions. If you’re ready to look at properties with honest pricing and simple financing, a great place to begin is by browsing what we have available.