How to Buy Rural Land: A Step-by-Step Roadmap from Search to Closing

Ross AmatoShare

Buying rural land is more straightforward than you might think. It boils down to a three-part journey: figuring out what you want, doing your homework on the property, and then lining up the financing. This guide is your roadmap, built from our experience helping first-time buyers go from dreaming about a piece of land to holding the deed in their hand.

Starting Your Journey to Land Ownership

Buying your first parcel of raw land can feel like a huge undertaking, but it doesn't have to be. It's often a much simpler process than buying a house, which involves complicated inspections and mortgage hurdles. The key to success is breaking the whole thing down into smaller, more manageable steps.

Here at Dollar Land Store, we believe everyone deserves a chance to own land. That's why we put this guide together—to pull back the curtain and make the process clear and accessible for beginners. We'll show you the right questions to ask, where to find accurate information, and how to sidestep the common mistakes that trip up new buyers.

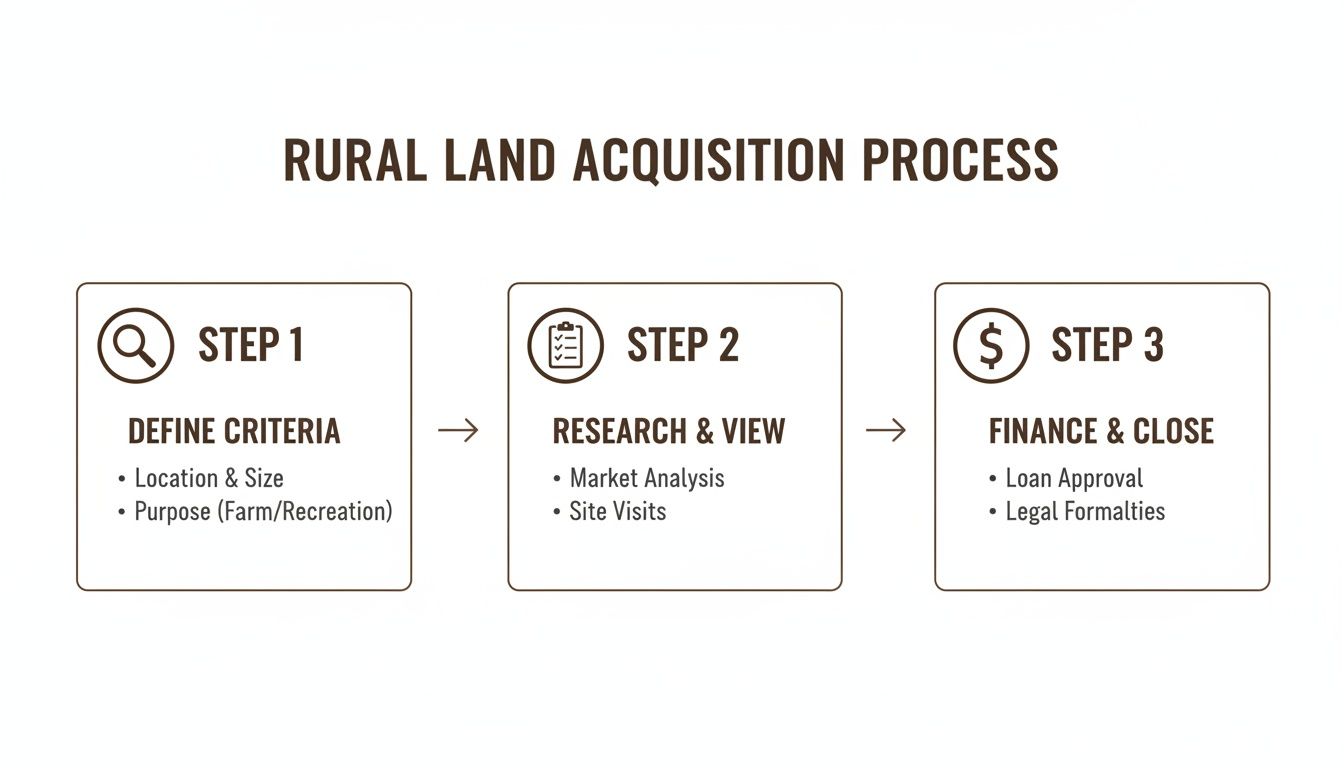

This simple visual breaks down the land-buying journey into three fundamental stages.

As you can see, a successful purchase always starts with clarity. You have to know what you’re looking for before you dive into research and financing.

Let's organize the entire process into three distinct phases, each with its own set of actions and a clear goal.

The Three Phases of Buying Rural Land

| Phase | Key Actions | Primary Goal |

|---|---|---|

| 1. The Vision Phase | Define your "why," list must-haves, set a realistic budget, and identify your ideal region. | To create a clear, actionable plan that filters out unsuitable properties from the start. |

| 2. The Research Phase | Find listings, verify access and utilities, check zoning and restrictions, and visit properties in person. | To thoroughly vet a specific parcel and confirm it meets all your practical and legal needs. |

| 3. The Closing Phase | Choose a financing path (cash, bank, or owner-finance), complete surveys, sign documents, and get the deed. | To legally and financially secure ownership of your chosen property without any hidden surprises. |

By thinking about your journey in these three phases, you can stay focused and ensure you don't miss any critical steps.

Defining Your Vision

Before you even start scrolling through listings, the most important thing you can do is define what you really want out of a property. Is this a spot for weekend camping trips? A future off-grid homestead? Or just a simple long-term investment?

Your end goal drives every other decision. A piece of land that's perfect for a hunter might be a total bust for someone who wants to build a cabin, perhaps due to zoning rules or a lack of utility access.

Your "why" is your most powerful tool. It acts as a filter, helping you instantly discard unsuitable properties and focus your energy on the ones that align with your long-term vision.

The Importance of Due Diligence

Once you have a clear vision, it’s time for due diligence. This is just a practical term for the detective work you do to make sure a property is what it seems and to uncover any potential red flags before you sign any documents.

This is the part where you confirm things like:

- Zoning and Land Use: Does the county actually allow what you want to do, whether that’s building, parking an RV, or keeping a few chickens?

- Property Access: Can you legally and physically get to your land? Is it right on a county road, or will you need an easement to cross a neighbor's property?

- Utilities and Water: Is there a power line nearby you can tap into? For water, will you need to drill a well, set up a rain catchment system, or have it delivered?

Doing this research protects you from expensive headaches down the road and makes sure the land you buy will actually work for you.

Understanding Your Financing Options

Finally, you’ll need to think about how you're going to pay for it. Most traditional banks are hesitant to lend money for raw land, which can be a huge roadblock for many people. This is where owner financing can be a game-changer.

Companies like Dollar Land Store specialize in this. We offer a direct path to ownership without the credit checks and piles of paperwork that banks require. This makes buying land possible for so many more people, letting you secure your property with a low down payment and a monthly installment you can actually afford. As we’ll discuss later, this option removes one of the biggest hurdles to owning land.

How to Find and Evaluate Your Ideal Property

Finding that perfect piece of land is an exciting hunt, but it’s about more than just pretty pictures online. The search for rural property has moved beyond local real estate offices. These days, you have a ton of resources at your fingertips, and each one offers something different for a first-time buyer.

The trick is knowing where to start. You could scroll through the big real estate websites, but you’ll spend half your time filtering out houses and developed lots. A much smarter approach is to use platforms that specialize in raw land.

That's where specialized direct sellers, like us at Dollar Land Store, come in. We offer a curated inventory of affordable, undeveloped parcels. Because we sell directly to you, we cut out the middlemen and commissions, which often means lower prices and a much simpler buying process.

Decoding a Land Listing

Once you start looking, you’ll see land listings are a different beast than home ads. They use specific lingo, and understanding it is the first step to knowing if a property is worth a closer look.

Here are the critical details to lock in on:

- APN (Assessor's Parcel Number): This is the property's unique ID number, used by the county for taxes and records. Think of it as the land’s social security number—it's the most reliable way to look up official info.

- Legal Description: This isn't the mailing address. It's the formal, official description used on deeds that spells out the property’s exact boundaries, often referencing things like subdivision names, lot numbers, or section-township-range coordinates.

- GPS Coordinates: These numbers pinpoint the property’s location on the globe. You can pop them right into Google Maps or your GPS to see where it is and even navigate your way there.

These three pieces of information are your starting point for any real research. They let you cross-reference and make sure the land being advertised is the exact same one you're investigating with the county.

Desktop Due Diligence: Saving Time and Money

Before you burn a tank of gas driving out to a remote spot, you can learn a shocking amount about a property right from your computer. This "desktop due diligence" is your secret weapon for quickly weeding out duds.

Your first stop should be the county’s GIS (Geographic Information System) mapping tool. Most counties have these online for free, and they are goldmines of information—interactive maps layered with all sorts of public data.

Using the property's APN, you can hop on the county GIS and:

- Confirm the exact property lines.

- Check for potential floodplains or protected wetlands.

- See who owns the neighboring parcels.

- Pull up topographical maps to understand the slope and terrain.

This quick digital scout can save you from a wasted trip to a property that turns out to be on the side of a cliff or in the middle of a seasonal creek bed. For a deeper dive, check out our guide on what to look for when buying land.

The On-Site Visit: What to Look For

Once a property passes your screen test, it's time to put boots on the ground. This is where you verify everything you've learned and get a real feel for the place.

When you're out there, pay attention to the practical stuff. For instance, you'll need to think about water. Even if you're just camping, you'll need to plan for essential water storage solutions.

Bring a checklist so you don't forget anything important:

- Physical Access: Can your car actually make it to the property? Is the road washed out, overgrown, or behind a locked gate?

- Terrain and Usability: Walk the property from corner to corner. Where are the flat, usable spots for a campsite or future build? Are there hidden ravines or areas that are too rocky to be useful?

- Environmental Clues: Look for signs of trouble—water pooling, evidence of illegal dumping, or aggressive, invasive plants taking over.

- Neighborhood Vibe: What do the neighbors' properties look like? Are they well-kept homesteads or junkyards? It tells you a lot about the area.

Understanding the local market is also key. According to the USDA, the average U.S. farm real estate value was $4,350 per acre in 2023. But that number can be misleading—cropland in the Pacific region hit $9,830 per acre, while pasture in the Mountain states averaged just $946. This kind of data helps you figure out if a property’s price tag is fair for its location and what it offers.

Mastering Your Due Diligence Checklist

Due diligence is, without a doubt, the most important part of buying land. This is the real work—the investigation you do to uncover the absolute truth about a property and dodge costly, heartbreaking surprises down the road.

Think of it as your own private investigation. You’re simply verifying every claim made in the listing to make sure the parcel is exactly what you need it to be. A pretty photo or a low price is tempting, but it tells you nothing about legal access, usage restrictions, or hidden headaches. This is your shield against buying a piece of land you can't legally get to or use the way you dreamed.

This process isn't about being cynical; it's about being smart. Investing a few hours in phone calls and online research now can save you thousands of dollars and years of regret.

To get you started, here is a simple checklist covering the essentials.

Essential Due Diligence Checklist

| Check | Where to Verify | Potential Red Flag |

|---|---|---|

| Zoning & Land Use | County Planning & Zoning Dept. | "Agricultural Use Only," strict camping limits, or no residential builds allowed. |

| Legal & Physical Access | County GIS Maps, County Recorder | The property doesn't touch a public road and has no recorded easement. |

| Utilities (Power) | Local Electric Utility Company | No service in the area; extending a line costs tens of thousands of dollars. |

| Water Source | State Water Resources Dept., Local Well Drillers | Neighboring wells are extremely deep, dry, or have poor flow rates. |

| Septic System Feasibility | County Health/Environmental Dept. | The property failed a perc test in the past; soil is unsuitable for a septic system. |

| Title History | County Recorder's Office, Title Company | Unpaid tax liens, ownership disputes, or claims from other parties (liens). |

This table is your starting point, but let's break down exactly what you're looking for in each of these critical areas.

Verify Zoning and Land Use Regulations

Zoning rules are the law of the land, set by the county to control how property in a specific area can be used. This is non-negotiable. If a property is zoned for "agricultural use only," you can't build a single-family home on it, no matter how perfect the spot is.

Never take a seller's word for it. The only way to get a definitive answer is to call the county's Planning & Zoning department. Give them the property’s APN (Assessor's Parcel Number) and ask direct questions:

- "What is the official zoning for this parcel?"

- "Are there restrictions on RV camping, and if so, for how long?"

- "What are the minimum acreage requirements to build a residential structure?"

This single step can immediately tell you if the property is a non-starter for your plans. For a deeper dive, check out this guide to understanding local zoning regulations.

Confirm Physical and Legal Access

This is a huge one that trips up so many first-time buyers. A property must have both physical access (a road you can actually drive on) and legal access (a documented right to use that road). Just because a dirt path leads to the property doesn't mean you have the legal right to be on it.

If the road crosses a neighbor's land, you need a deeded easement. Without one, that neighbor could put up a gate tomorrow and block you out. Suddenly, your property is "landlocked."

A landlocked parcel is a property with no legal access from a public road. It can be nearly worthless without a deeded easement, as you have no guaranteed way to reach it.

To check this, pull up the county GIS map. If the property doesn't directly touch a publicly maintained road, you need to dig into the title history for recorded easements. You can usually find this information at the County Clerk & Recorder’s office.

Investigate Utilities and Water Sources

For raw, undeveloped land, you can't assume anything about utilities. Your next job is to find out what it would really take to get power, water, and septic service to your spot.

- Power: Call the local electric utility. Give them the property’s location and ask if they serve the area and what the cost would be to run a line. It can sometimes cost tens of thousands of dollars.

- Water: Does the area rely on wells? Check with the state's water resources department for well data. You're looking for the average depth and success rate for drilling nearby.

- Septic: The county health or environmental department is your contact here. They’ll tell you the requirements for a septic permit, including whether a "perc test" (percolation test) is needed to see if the soil can even support a septic system.

Review the Title History

The title history, or "chain of title," is simply the record of a property's ownership over time. A clean title means the seller has the undisputed right to sell it to you, free of any liens, back taxes, or claims from other parties.

You can order a professional title report from a title company. For lower-cost parcels, you can often do a preliminary check yourself at the County Recorder's office. Look for red flags like unpaid property tax liens, mechanic's liens from unpaid contractors, or unresolved ownership disputes.

This checklist is your roadmap to a secure purchase. It empowers you to move forward with confidence, knowing you've looked under the hood and verified every critical detail.

Navigating Financing for Rural Land Purchases

Buying a piece of raw land isn't like getting a mortgage for a house. It's a different world, and many first-time buyers are surprised to find that traditional banks often get skittish when it comes to undeveloped property. They see it as a risk, which can make getting a loan a real headache.

But that’s where knowing your options comes in. The right financing path can make land ownership a reality for almost anyone.

The biggest hurdle with conventional lenders is simple: there's no house on the land. Without a physical structure to serve as collateral, banks get nervous. This means they often demand massive down payments—sometimes up to 50%—and require stellar credit scores. For the average person looking to buy an affordable rural lot, this is usually a deal-breaker.

Thankfully, there’s a much more direct and common-sense route: seller financing.

The Power of Seller Financing

Seller financing, or owner financing, is exactly what it sounds like. The person or company selling the land—in our case, Dollar Land Store—acts as the bank. You make your payments directly to the seller over an agreed-upon term, cutting out the middleman entirely.

This approach completely changes the game. It knocks down the barriers that banks throw up, making land ownership achievable for people from all walks of life.

The benefits are straightforward and powerful:

- No Credit Checks: Your credit score isn't part of the equation. The land itself is the security for the loan.

- Low Down Payments: Forget needing tens of thousands of dollars. You can often secure a property with a very small payment to get started.

- Instant Approval: The process is refreshingly simple. No underwriting committees, no mountains of financial paperwork.

- Fixed Payments: You'll know exactly what your monthly payment is for the life of the loan, which makes budgeting a breeze.

This method opens the door for so many people—the self-employed, folks with less-than-perfect credit, or anyone who simply doesn’t want the hassle of dealing with a traditional lender. To see how it works in more detail, check out our guide on how seller financing paves the road to land ownership.

A Real-World Payment Example

Let's walk through a typical scenario to see just how affordable this can be. Imagine you've found a 5-acre parcel you love with a total purchase price of $10,000.

Here’s how the numbers could break down with a seller financing plan:

- Purchase Price: $10,000

- Down Payment: $250

- Amount Financed: $9,750

- Loan Term: 10 years (120 months)

- Interest Rate: 9%

In this case, your monthly payment would be just $123.51. That simple math shows how a nice piece of land can be yours for less than most people’s monthly cell phone bill. It takes the dream of owning land from a distant goal and makes it an immediate, affordable reality.

The goal of seller financing is accessibility. It’s built on the idea that you shouldn’t need a massive cash reserve or a perfect credit score to own your own slice of the American landscape.

When you see companies offering land for "$1 Down," this is the model they’re using. You pay a tiny amount upfront plus a one-time document fee to make the property yours, then start making affordable monthly payments. It’s a transparent, simple path to ownership designed for everyday people.

What This Means for First-Time Buyers

For a first-time land buyer, this information provides a clear and actionable path forward. Understanding the process in phases—Vision, Research, and Closing—prevents you from feeling overwhelmed. The most critical takeaway is that you are in control. By focusing on diligent research and asking the right questions, you can avoid common pitfalls and make a confident purchase.

The biggest challenge for most beginners is financing. Knowing that traditional banks are often not an option for raw land helps set realistic expectations. More importantly, learning about seller financing reveals an accessible alternative that puts land ownership within reach for almost any budget. Instead of seeing a high purchase price as a barrier, you can see it as a manageable monthly payment, much like a car or phone bill. This shift in perspective is often the key that unlocks the door to owning your first property.

Why Consider Dollar Land Store?

Buying rural land can feel overwhelming, especially if it's your first time. The market can be competitive, traditional bank loans are tough to get for raw land, and just finding a decent, affordable property can feel like a full-time job.

That’s exactly why we started Dollar Land Store. Our mission is to make land ownership simple, transparent, and accessible for everyone, not just big investors. We sell our own inventory of land parcels directly to you, which cuts out real estate agent commissions and passes those savings on. It’s a clear, straightforward path to owning your own piece of land.

By selling directly to you with our own owner financing, we’ve built a process around a few core principles:

- Affordable Land with Low Payments: We specialize in low-cost land with small down payments and monthly terms that fit a real-world budget.

- Simple Owner-Financing: Our no-credit-check financing means your financial history won't prevent you from buying land. The property itself is the collateral.

- Transparent Terms: No hidden fees, no last-minute surprises. Every cost is laid out from the start, so the price you see is what you pay.

- No Middlemen: Because we own the land we sell, you deal directly with us. This streamlines the process and removes confusing third parties.

- Broad Inventory: We acquire land across several states, giving you access to an inventory you won't find on the big real estate websites.

Our entire model is built on trust and simplicity. We handle the paperwork, set up the financing, and are always here to answer your questions. We want your journey from browsing our site to standing on your own land to be as smooth as possible.

Next Steps: From Browsing to Owning

You’ve found the perfect parcel, nailed down the financing, and done your homework. Now comes the best part: making that piece of land officially yours. This is where handshakes turn into legal ownership, and it’s a lot simpler than you might think, especially with seller financing.

Once you’re ready to move forward, the first official step is signing a purchase agreement or land contract. This is the master document for the deal. It lays out all the terms you and the seller agreed upon—price, financing, timeline, and everything else. It’s what makes the deal legally binding and protects everyone involved.

Key Paperwork in a Seller-Financed Deal

With a seller-financed deal, you skip the mountain of paperwork that comes with a traditional bank loan. It usually boils down to a few straightforward documents:

- Promissory Note: This is your written promise to pay back the loan. It clearly states the total amount you’re financing, the interest rate, your monthly payment, and the loan term.

- Deed of Trust or Mortgage: This document is the seller's security. It gives them a legal claim to the property until you’ve paid off the loan.

- The Deed: This is the most important document. It’s the official paper that transfers the property from the seller’s name to yours.

After you’ve made your final payment, the seller will sign and record a new deed that officially puts the property in your name, free and clear.

Recording the Deed and Taking Title

After you sign the purchase agreement and make your first payment, the final step is to make it official with the county. The signed deed needs to be filed with the County Clerk and Recorder’s Office (the exact name of the office can vary). This is a crucial step because it puts your name on the public record as the new owner.

Don’t skip this. An unrecorded deed can cause major ownership headaches. While you’re making payments on a seller-financed property, the seller typically holds the title, but your contract secures your right to it.

Taking title just means you've legally acquired the rights of ownership. Once that deed is recorded in your name, you are the official owner. From that point on, you’re responsible for things like property taxes and following local rules.

As a long-term investment, buying rural land has proven its worth. U.S. farmland values have hit record highs, marking several straight years of growth. A USDA report showed that the average value for U.S. farm real estate climbed to $4,350 per acre. You can dive into the details by reading the full NASS Land Values report.

Conclusion: Your Path to Land Ownership

Buying rural land is an achievable goal for anyone willing to do a little research. The process is not nearly as complex as buying a home, and the rewards—freedom, privacy, and a tangible asset—are immense. By defining your vision, committing to thorough due diligence, and exploring accessible financing options like seller financing, you can confidently navigate the path to ownership. The dream of having your own piece of the country is closer than you think.

Ready to stop dreaming and start owning?

Browse our available land listings and find your perfect parcel today!