Property Taxes on Vacant Land: A Clear Guide for First-Time Buyers

Ross AmatoShare

Before you jump into buying that perfect piece of land, there’s one recurring cost every first-time buyer needs to understand: property taxes on vacant land. Even an untouched, empty parcel comes with a yearly tax bill.

Think of it as your contribution to the community services that make your land accessible and valuable—things like roads, schools, and emergency responders. Property taxes are a non-negotiable cost of ownership, and factoring them into your budget from day one is the key to a smart, stress-free purchase. This guide will walk you through exactly how they work, so you can buy with confidence.

Why Does My Empty Land Have a Tax Bill?

It’s a fair question. If there’s no house, no one living on it, and no direct use of services, why does the county send a bill? The answer is that property taxes fund the public services that benefit the entire community, including every landowner.

Even if your parcel is completely raw and undeveloped, it still benefits from the civic infrastructure that tax dollars pay for. These are the essentials that protect your investment:

- Public Roads: The very roads that provide access to or near your property are built and maintained with tax money.

- Emergency Services: Your local fire department, police, and paramedics are funded by property taxes, ready to respond if needed.

- School Districts: Even if you don’t have children, strong local schools make an area more desirable, which helps protect and grow your land’s long-term value.

- County Administration: Taxes cover the operations of the county assessor and recorder’s offices—the people who keep property records accurate and your ownership legally recognized.

Ultimately, your property tax is an investment in the system that makes your land accessible, safe, and secure. For a deeper dive into how this system works across different types of properties, you can find great information on real estate tax.

The Two Pillars of Your Tax Bill

Understanding your tax bill is straightforward once you know the two key parts of the puzzle. Every property tax calculation, whether for a downtown skyscraper or a remote 5-acre lot, boils down to these two numbers:

- Assessed Value: This is the official value the county assigns to your land for tax purposes. It's important to know this is not always the same as the market value or the price you paid. The county assessor calculates this based on factors like size, location, zoning, and sales of similar nearby properties.

- Millage Rate (or Tax Rate): This is the tax rate set by local governments—your county, city, school district, etc. A "mill" is simply one-thousandth of a dollar. So, if the local millage rate is 20 mills, it means you’ll pay $20 for every $1,000 of your property's assessed value.

The county simply multiplies your land’s assessed value by the local millage rate to get your annual tax bill. This core formula is the foundation for budgeting for your new land purchase.

How Your Vacant Land Property Tax Is Calculated

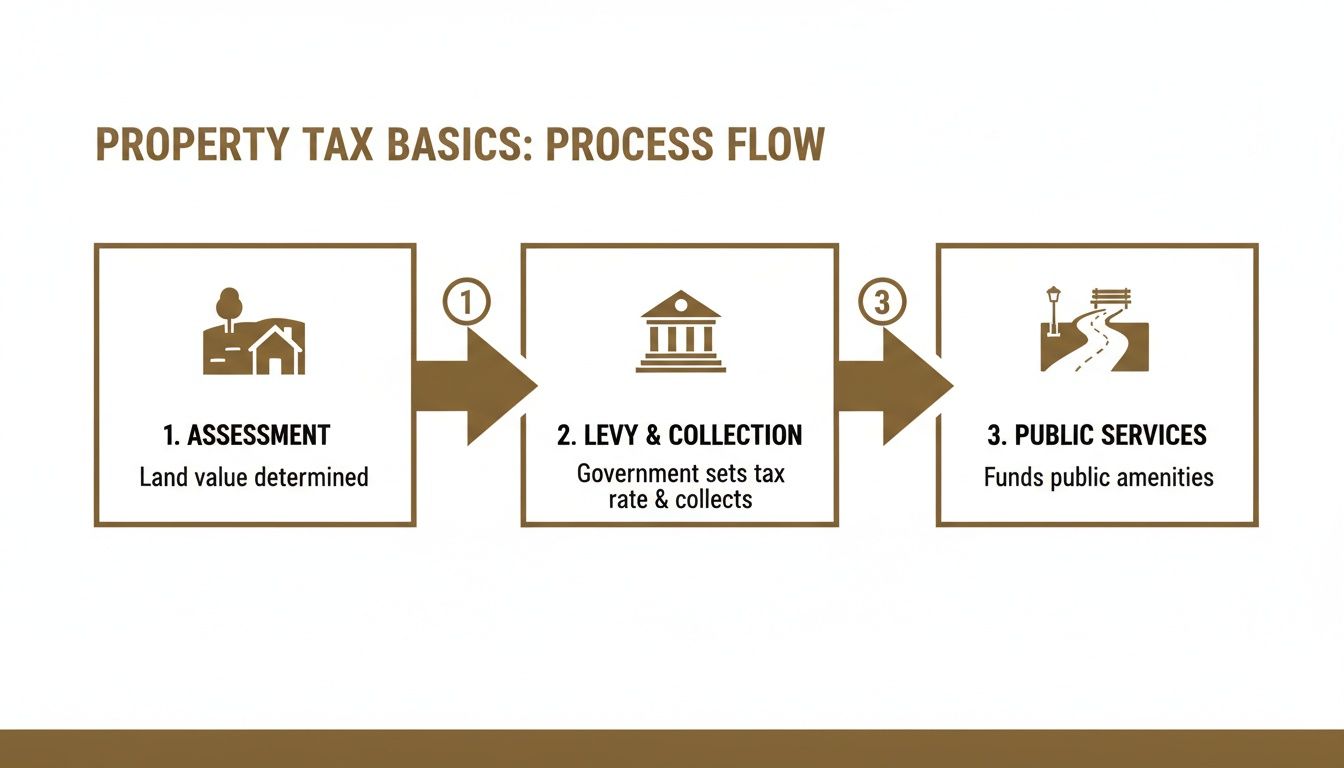

Figuring out a county’s tax calculation for a piece of empty land might seem like a mystery, but it follows a clear, predictable process. Local governments use a simple formula based on your land’s value and what it costs to run the community.

The entire process comes down to two key numbers: the assessed value of your land and the local millage rate. Once you understand those two components, you can estimate your future taxes with confidence and avoid any surprises.

This is how your land ownership directly supports the local services that make the area a great place to own property.

As you can see, there's a straight line connecting your land’s value, the taxes collected, and the funding for things like roads, schools, and emergency services that benefit your property.

Step 1: Determining the Assessed Value

The process starts with the county assessor, whose job is to determine the official value of your land for tax purposes. This number is called the assessed value, and it's critical to remember it is not the same as the market price you actually paid.

So, how do they arrive at that number? Assessors look at a few key factors:

- Recent Sales Data: What have similar vacant parcels sold for in the area recently? This is usually the most significant factor.

- Location and Access: A property with paved road access will almost always be assessed higher than a remote, landlocked parcel. Proximity to a town or other desirable features also adds value.

- Size and Topography: The total acreage matters, but so do the physical features. Steep slopes, wetlands, or rocky terrain that could make building difficult are all taken into account.

- Zoning and Land Use: The official designation for the land—whether it's zoned for residential, agricultural, or commercial use—has a huge impact. Assessors often consider its "highest and best use," meaning what it could be used for, not just how it sits today.

Key Takeaway: The assessed value is the county’s official appraisal of your land's worth for taxation. You can—and should—find this number on the county assessor’s website, as it’s the foundation for your entire tax bill.

Step 2: Applying the Millage Rate

Once the assessed value is set, the county applies the millage rate. This is the tax rate set by local government bodies like the county commission, the school district, and the fire department to fund their annual budgets.

The word "mill" is just a simple way of saying one-thousandth of a dollar. So, if the tax rate is 10 mills, it just means you pay $10 for every $1,000 of your land’s assessed value.

The final math is straightforward:

Assessed Value x (Millage Rate / 1,000) = Annual Property Tax Bill

A Real-World Example

Let's walk through an example. Imagine you just bought a 5-acre rural parcel.

- The county assessor determines the Assessed Value is $20,000.

- The total Millage Rate for the county, schools, and other local services comes to 15 mills.

This table breaks down each step of the calculation using our example numbers.

Sample Property Tax Calculation for Vacant Land

| Calculation Step | Description | Example Value |

|---|---|---|

| 1. Assessed Value | The official value of the property set by the county assessor's office. | $20,000 |

| 2. Millage Rate | The combined tax rate from all local taxing authorities (county, school, etc.). | 15 mills |

| 3. Convert Mills | To use it in a formula, the millage rate is divided by 1,000. | 15 / 1,000 = 0.015 |

| 4. Final Calculation | Multiply the Assessed Value by the converted millage rate. | $20,000 x 0.015 |

| 5. Annual Tax Bill | The resulting amount is what you owe in property taxes for the year. | $300 |

And there you have it. Your annual property tax bill for that vacant land would be $300. This simple, predictable formula is your best tool for running the numbers on any property you’re considering, ensuring you can budget accurately for this important cost of ownership.

A Look at Tax Rules in Key Western States

Property tax rules are not one-size-fits-all. They can change dramatically from state to state, and even from one county to the next. For anyone looking at affordable rural land in the Western U.S., understanding these local differences is a key part of your research.

While you should always verify the exact numbers with official county sources, this overview will give you a general feel for the tax environment in key states. Knowing these basics helps you ask the right questions and plan your budget more effectively.

Arizona: A Friendly Climate for Landowners

Arizona is widely considered a taxpayer-friendly state. It often has lower-than-average property tax rates. The state assesses vacant land based on its Full Cash Value (FCV), which is what the land would likely sell for on the open market.

The key benefit for landowners is that taxes are calculated on the Limited Property Value (LPV), which by law cannot increase by more than 5% per year. This cap prevents sudden, shocking tax hikes even if market values in your area soar, adding a welcome layer of predictability.

Nevada: Simplicity and No State Income Tax

Nevada's tax system is a big draw, primarily because of its simplicity and the absence of a state income tax. While property taxes are a major source of funding for local communities, the state constitution caps the total tax rate at $3.64 per $100 of assessed value.

In Nevada, the assessed value is set at just 35% of the property's market value. This fractional assessment means your tax bill is based on a much smaller number than what you might have paid for the land, helping keep costs down. If that sounds appealing, exploring seller-financed land in Nevada is a great way to start your land ownership journey.

Colorado: The Vacant Land Divide

Colorado’s property tax system can be more complex, and there's one major detail every land buyer needs to know: the significant difference in how it treats residential property versus vacant land. Historically, vacant land has been assessed at a much higher rate—sometimes more than four times higher than a residential lot of the same market value.

This is a huge factor if you plan to buy land and hold it for a while before building. The property taxes you’ll pay on that empty lot will likely be much higher than what you'll pay once you build a home and the property is reclassified as residential. Always call the county assessor to confirm the current assessment rate for "non-residential" or vacant land.

Heads Up: State tax laws are always evolving. Colorado, in particular, has been adjusting its property tax code. Before you buy, double-check with the local county for the most current rates and rules.

California: The Power of Proposition 13

California’s property tax system revolves around Proposition 13, a law passed in 1978. It boils down to two powerful rules for landowners:

- The maximum annual property tax rate is capped at 1% of the property's assessed value (plus any small, voter-approved local fees).

- Once you own it, the assessed value can only increase by a maximum of 2% each year, regardless of how much market values climb.

When a property sells, it gets reassessed at its new market price. This means as a new buyer, your first tax bill might be higher than what the previous owner was paying. But after that initial reset, Prop 13 provides incredibly stable and predictable tax bills for as long as you own the property. This makes budgeting for property taxes on vacant land in California refreshingly straightforward after the first year.

Finding Potential Tax Breaks for Your Land

Property taxes are a fact of land ownership, but the amount you pay isn't always set in stone. Many landowners are able to lower their annual tax bill by enrolling their property in specific land-use programs. These aren't loopholes; they are incentives from local governments designed to encourage good stewardship, such as farming, conservation, or forestry.

If you can align your long-term goals for the property with one of these programs, your land can become a far more affordable investment. Just keep in mind that these benefits usually require a real, long-term commitment to a certain land use.

Agricultural Exemptions and Classifications

One of the most common ways to lower your property tax bill is to qualify for an agricultural exemption. This isn't a true "exemption" where you pay nothing; instead, it reclassifies your land based on its agricultural use rather than its full market value.

To get this break, you have to prove your land is being used for genuine farming or ranching. The good news is you don't have to become a full-time farmer. Many landowners meet the requirements by:

- Leasing to a Farmer: It can be as simple as leasing your land to a local rancher for grazing cattle or to a farmer for growing hay.

- Timber Production: In many states, managing your land for a sustainable timber harvest counts as an agricultural use.

- Meeting Minimum Acreage: Counties usually set a minimum acreage to qualify, preventing claims on small residential lots.

The savings can be substantial. An agricultural classification can sometimes cut your land's assessed value by 50% to 90%, resulting in a dramatically lower tax bill.

Conservation Easements

If your primary goal is to protect the natural beauty of your property, a conservation easement might be a perfect fit. This is a voluntary legal agreement where you agree to permanently limit certain types of development to protect the land’s scenic or natural features.

In return for giving up some development rights, you can receive significant tax benefits, often including a lower annual property tax bill. It’s a great option for owners who value preservation and want to leave a legacy while also getting a financial benefit.

Forestry and Open Space Programs

Many states have special tax programs for land dedicated to managing forests or being kept as open space. These programs recognize the public good that comes from well-managed forests and undeveloped land.

Key Insight: These programs aren't just for massive timber operations. Depending on the state, even smaller parcels of 5 to 20 acres might qualify for a forestry management plan, opening a path to lower property taxes.

Understanding these policies is critical for any land buyer. With millions of vacant properties nationwide, some communities are exploring new tax policies to encourage productive land use. You can learn more about how tax policies are addressing vacant properties to see how the landscape is shifting.

What This Means for Buyers

Let's cut through the jargon and get to what really matters. Property taxes might seem complicated, but they should be viewed as a predictable, manageable expense—not a barrier to owning your own piece of land. For anyone buying for the first time, the golden rule is simple: always research the taxes before you commit.

Knowing this one cost upfront is the key to making a confident, smart decision. It puts you on solid financial ground from day one, so you can enjoy your new land without the stress of an unexpected bill.

Your Most Important Tool: The County Assessor Website

The single best place to get reliable tax information is the website for the county assessor or treasurer where your land is located. These government sites are the official source of truth.

Here’s what to look for:

- Tax History: Find the parcel you're interested in and check its tax history for the past few years. Has the bill been steady, or have there been big jumps?

- Assessed Value: Note the current assessed value. This is the number the county uses to calculate the tax bill.

- Millage Rates: Look for a breakdown of the local tax rates (millage rates). This shows you exactly where your money goes—to schools, roads, fire departments, etc.

Spending just 30 minutes on the county website can give you a surprisingly accurate picture of what you'll owe each year.

Pro Tip: Never rely solely on the seller's old tax bills. A change in ownership often triggers a reassessment, which could change the tax amount. Always verify the most current info directly with the county.

Budgeting for Taxes with Owner Financing

When you buy land with owner financing, like the simple plans offered at Dollar Land Store, it’s important to remember that property taxes are paid separately. Your monthly payment to us covers the land itself, but you are responsible for paying the annual tax bill directly to the county.

Factoring this in is easy:

- Find the annual tax amount on the county assessor’s website.

- Divide that number by 12 to get your estimated monthly tax cost.

- Add that amount to your monthly land payment to determine your true total monthly cost of ownership.

Understanding tax policies also provides a bigger-picture view of how land is managed. Around the world, different tax systems are used to encourage development. Some countries even use a "land value tax," which taxes the land more heavily than the buildings on it. If you're curious, you can discover insights on how land value taxes impact housing. Learning about different approaches can deepen your understanding of real estate. For more foundational knowledge, our guide on purchasing raw land for sale is a great place to start.

Why Consider Dollar Land Store?

Buying land, especially for the first time, can feel complicated. Sorting through details like property taxes on vacant land is much easier when you have a straightforward partner. At Dollar Land Store, our entire business is built on making land ownership clear, affordable, and accessible for everyone.

We believe you should feel confident in your purchase, and that starts with understanding all the costs upfront. That’s why our listings provide the key details you need—like the Assessor’s Parcel Number (APN)—so you can easily research taxes and local rules directly with the county. We are not a traditional real estate agency; we sell land we own, which makes the process simpler.

Here’s why buyers trust us:

- Affordable Land with Low Payments: We specialize in rural land at low entry costs, making ownership achievable.

- Simple Owner-Financing: We offer straightforward seller financing with no credit checks and transparent terms.

- No Middlemen: Because we own every parcel we sell, there are no real estate agents or commissions involved. You work directly with us from start to finish.

- Fast and Transparent Process: We handle the paperwork, and our contracts are simple and easy to understand.

- Broad Inventory: We offer a wide selection of properties across several states, giving you more options.

Our goal is to be a logical, trustworthy solution for buying rural land. We want to make your journey to land ownership as clear and affordable as it can be.

Your Next Steps to Smart Land Ownership

Knowledge is the foundation of any smart land purchase. Now it’s time to put what you’ve learned about property taxes on vacant land into action. This simple checklist will help you confidently determine the true cost of any parcel before you buy.

Your Due Diligence Checklist

Following these steps will help you avoid tax-related surprises and ensure your purchase fits your budget.

-

Find the Assessor’s Parcel Number (APN)

This unique ID is the key to all public records for a property. You can find it on the property listing or by contacting the county. -

Visit the County Assessor’s Website

Every county has an online portal. Use the APN to search for the specific parcel. -

Review the Tax History

Look at the tax records for the past three to five years. Note the assessed value and the total tax bill each year to see how stable the taxes have been. -

Confirm the Current Tax Rate

Find the official millage rate or tax rate schedule on the county site. -

Call the County Directly

This is the most important step. Call the assessor’s or treasurer’s office, provide the APN, and ask them to confirm the current annual tax amount. While on the phone, ask if a change in ownership will trigger a reassessment.

A quick phone call is the most reliable way to get accurate, up-to-the-minute information. It’s a crucial part of responsible due diligence.

With this information in hand, you can move forward with total confidence. Ready to find that perfect property? Start by exploring the affordable options at Dollar Land Store, where transparency is built into every transaction.

- Browse available land at DollarLandStore.com.

- Explore our seller-financed land options.

- Contact us with your questions about buying raw land.

Conclusion

Understanding property taxes on vacant land is an essential step toward becoming a confident landowner. While it may seem complex at first, the process is logical and predictable. By knowing how to find the assessed value and local tax rates, you can accurately budget for this recurring cost and avoid any future surprises.

Remember, taxes are not a barrier but a manageable part of ownership that funds the very services that make your land valuable. With a little research and the right partner, you can navigate the process smoothly and turn your dream of owning land into a reality.