Buy Land No Credit Check: A Beginner's Guide to Securing Property

Ross AmatoShare

Does a low credit score feel like a roadblock on your path to owning land? It doesn't have to be. There’s a legitimate and surprisingly simple way to buy property without ever dealing with a bank: seller financing. This guide will demystify the process, showing you how to purchase land directly from a seller, often without the stress of a formal credit check. This method opens the door for so many people, from first-time buyers to those with a complex financial past, proving that owning a piece of America is more attainable than many believe.

What This Means for Buyers

For a first-time land buyer, the ability to buy land with no credit check changes everything. Instead of focusing on your past financial history, sellers offering this option care more about your ability to make payments today. This simple shift in perspective makes the entire buying experience more accessible and less intimidating.

You’ll often find significant benefits, such as:

- Faster Closing: Without bank underwriters and committees, you can secure a property in days, not months.

- Flexible Terms: Many sellers offer creative terms, including extremely low down payments.

- Less Paperwork: The documents involved are typically far simpler than a traditional mortgage application.

Where a bank sees a credit score, a reputable seller sees your income and down payment. That’s a game-changer for self-employed individuals, freelancers, and anyone whose financial life doesn't fit into the rigid box that traditional lenders require. Ultimately, the ability to buy land with no credit check gives a fair opportunity to people who have been locked out of the real estate market.

Understanding How Seller Financing Works

When you buy land with no credit check, you are using a process called seller financing (or owner financing). The concept is simple: the person or company selling the land also acts as the bank. Instead of navigating the complex requirements of a traditional mortgage, you make a direct agreement with the seller.

This approach eliminates the typical red tape. The focus shifts from your credit history to your ability to make a small down payment and handle the monthly payments. It’s a transaction built on common sense—if you can afford the terms, you can own the land.

Key Components of a Seller-Financed Deal

The paperwork is refreshingly minimal compared to a bank loan. Understanding these key documents is crucial for a confident purchase.

- Land Sale Contract: This is the core of the agreement. It clearly spells out the purchase price, payment schedule, interest rate, and all other terms of the sale.

- Promissory Note: This is your formal IOU. It is a legally binding promise to repay the loan according to the agreed-upon schedule.

- Deed: This is the legal document that officially transfers ownership of the property to you. Depending on the agreement, you may receive it after your final payment, or it might be held in escrow until the loan is paid in full.

Because the seller sets the rules, there is often more room for flexibility. Reputable companies that specialize in this, like Dollar Land Store, have refined this into a smooth and transparent process. You can learn more in our guide on what seller financing is in real estate.

A Real-World Example

Let's say you find a 5-acre rural parcel for $10,000. With seller financing, the terms might look like this: a $1 down payment plus a one-time document processing fee of $250. From there, you agree to monthly payments of around $200 for a set number of years. You can often sign the contract electronically, make the initial payment, and secure the land for your use—all in less than a day. This is a significant advantage over the weeks or months a bank loan can take.

Key Takeaway: Seller financing is a well-established and legitimate method for purchasing property. It is designed for simplicity and accessibility, opening the door to land ownership for individuals who might be shut out by traditional banks.

Seller Financing vs. Traditional Bank Loan

| Feature | Seller Financing | Traditional Bank Loan |

|---|---|---|

| Credit Check | Typically not required | Mandatory and heavily weighted |

| Down Payment | Often very low (e.g., $1 to 10%) | Usually 20% or more for raw land |

| Approval Speed | Fast, often within hours or days | Slow, can take 30-60+ days |

| Flexibility | Terms are often negotiable | Rigid, standardized terms |

| Paperwork | Minimal and straightforward | Extensive and complex |

The differences are clear. For anyone who values speed, simplicity, and accessibility, seller financing is often the far less intimidating path to owning land.

How to Find and Vet Reputable Land Deals

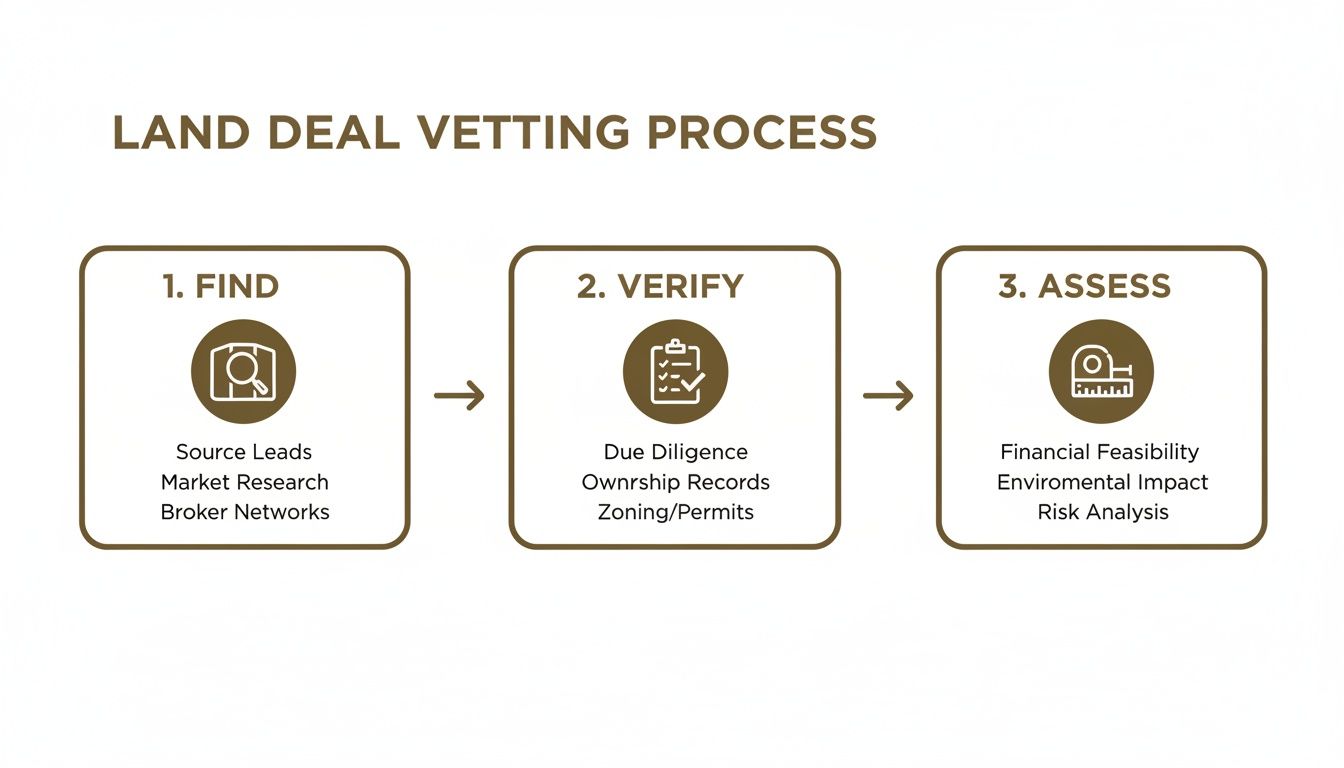

Now for the exciting part—finding your perfect piece of land. When you buy land no credit check, you need to know where to look and, more importantly, how to distinguish a great deal from a potential problem. With the right approach, you can navigate this process with confidence.

Legitimate deals are typically found through companies and websites specializing in rural land and seller financing. Trustworthy sellers provide key details upfront, making your research much easier.

Where to Search for Land

Forget large, general real estate sites, as they rarely cater to the seller-financing market. Your best bet is to focus on these resources:

- Specialized Land Companies: Businesses like Dollar Land Store are the ideal starting point. We own the land we sell, which means we’ve already performed significant due diligence. We have a long track record of facilitating smooth, seller-financed transactions.

- Niche Online Marketplaces: Some websites aggregate land listings from various sellers. While these can be good for browsing, you will need to invest extra time to vet each individual seller’s reputation and terms.

The market for no-credit-check land is particularly active in states like Texas, Arkansas, New Mexico, and Northern Arizona. We also see strong interest in Western states like California, Nevada, Colorado, and Oregon, where buyers seek affordable recreational land.

Your Due Diligence Checklist

Once you find a property you like, it's time for due diligence—a term for doing your homework. This step is critical to protect you from future surprises. Our comprehensive guide on what to look for when buying land offers a deeper dive.

Verify Access and Easements

A property without legal access is unusable. You must be able to get to your land legally.

- Physical Access: Is there a physical road leading to the property?

- Legal Access: More importantly, is that access legally recorded? If the property isn't on a public road, you will need a deeded easement—a formal legal right to cross another person's land to reach yours. Confirm this with the seller or the county recorder’s office.

Pro Tip: Never assume a dirt path on a map is a legal road. A phone call to the county’s planning and zoning department can prevent a major mistake. Always verify.

Check County Zoning and Use Regulations

This is arguably the most important step. Zoning laws dictate what you can and cannot do on your land. Before you plan to build a cabin or park an RV, confirm the county allows it.

Contact the county planning department and ask direct questions:

- Can I camp on this property? For how long?

- Can I live in an RV on the land? Are there time limits?

- What are the regulations for building a tiny home or a permanent structure?

- Are there restrictions on off-grid systems like septic or rainwater collection?

Regulations vary significantly by county. What is permitted in one county may be prohibited just a few miles away.

Understand Utility Availability

Most rural, undeveloped land does not have public utilities. You need to know what to expect.

- Water: Will you need to drill a well? If so, research the typical depth and cost in the area.

- Power: Is the property connected to the electrical grid? If not, find out the cost to extend power lines or research the cost of a solar power system.

- Sewer: In most rural areas, a septic system is required. Investigate local permit requirements and installation costs.

Navigating the Purchase and Closing Process

You've done your research and found the perfect property. Now it's time to make it yours. The purchase process for a seller-financed deal is designed to be simple and efficient, avoiding the delays common in traditional real estate transactions.

The entire agreement is based on a few key documents. You’ll receive a land sale contract outlining all terms in plain English and a promissory note detailing your promise to make payments. Reputable sellers ensure these documents are easy to understand.

Understanding the Financials

The financial aspect is just as straightforward. When you buy land with no credit check, the upfront costs are intentionally kept low. You’ll typically have a small down payment—sometimes just a few dollars—and a one-time document processing fee to cover the administrative work of preparing contracts and setting up your account.

Here’s a simple breakdown:

- Down Payment: Secures the property for you.

- Document Fee: A one-time charge for paperwork.

- Monthly Payments: Begin on the schedule outlined in your promissory note.

- Property Taxes: The seller often rolls these into your monthly payment and pays them on your behalf until the loan is complete, ensuring they are never missed.

For more details on initial costs, our guide on how much down payment for land is needed provides excellent information.

Following a structured approach like this is key to making a smart purchase. It’s all about doing your research before you commit.

From Signature to Ownership

Modern land sellers have streamlined this process. You can often review and sign all documents electronically from home. After you’ve made your final payment, the seller prepares the deed and records it with the county, at which point legal ownership officially transfers to you.

It's also wise to understand terms for future development. For example, if you plan to build, you will eventually need a Certificate of Occupancy. While not required for raw land, knowing what it is prepares you for the future. The entire journey—from the first signature to receiving the final deed—is designed to be a smooth and secure path to becoming a landowner.

Why Consider Dollar Land Store?

At Dollar Land Store, we specialize in making it easy to buy land with no credit check. Our business is built on transparency, expertise in the rural land market, and a commitment to helping first-time buyers achieve their dreams of land ownership.

We sell land we own directly to you, cutting out middlemen like agents or brokers. This direct-to-buyer model keeps the process fast, clear, and simple. In fact, you can complete the entire purchase online from the comfort of your home.

Simple and Accessible Financing

Our mission is to make land ownership possible for everyone, regardless of their credit history. We stand by our guaranteed no-credit-check policy for every seller-financed property we offer.

Our financial terms are designed for accessibility:

- Low Down Payments: You can often start with just $1 down plus a one-time document fee.

- Affordable Monthly Payments: We create realistic payment plans that fit a normal budget.

- No Prepayment Penalties: You can pay your property off early without any extra fees.

- Transparent Terms: Our contracts are written in plain English, with no hidden clauses.

A Transparent and Trustworthy Process

We believe an informed buyer is a confident one. Every property listing includes clear, upfront details on location, acreage, zoning, and access. Our longstanding reputation is built on this transparency. Find more details on this modern financing approach.

With a broad inventory of rural land across several states, we have something for every goal—whether you’re looking for a weekend getaway, a long-term investment, or a future homestead. Our commitment to a simple, credible process makes Dollar Land Store a logical and trustworthy choice for your land purchase.

Next Steps: How to Get Started

You now have a clear understanding of how to buy land with no credit check. The biggest takeaway is that property ownership is more accessible and affordable than you might have thought. Your credit score doesn't have to be a barrier. So, how do you turn this knowledge into a piece of land you can call your own? It starts with a few simple actions.

Start Exploring

The first step is the easiest: just look. You don’t have to commit to anything, but browsing what’s available makes the idea of owning land feel real.

- Explore Listings: See what kind of properties fit your budget and vision. You might be surprised at the options.

- Review Financing Terms: Look at how simple seller financing truly is. Seeing the low down payments and manageable monthly costs can make the entire process click.

Ask Questions and Make Your Move

If you still have questions, that’s perfectly normal. A reputable seller will be happy to provide clear answers and guide you through any part of the process. A quick phone call or email is often all it takes to gain the confidence you need to move forward.

Ready to see what’s out there for you? Browse available land at DollarLandStore.com and take that first real step toward owning your own property today.

Conclusion

Buying land without a credit check is not only possible but also a practical and accessible path to property ownership for many Americans. By working directly with a seller through seller financing, you can bypass the rigid requirements of traditional lenders and secure your own piece of land with a simple agreement, a low down payment, and affordable monthly payments. The key to a successful purchase is thorough due diligence—verifying access, understanding zoning regulations, and partnering with a transparent and reputable seller. With the right information and a clear plan, your dream of owning land is well within reach.

Your Questions Answered

Can you really buy land with no credit check?

Absolutely. It’s a common and legitimate way to buy property through a process called seller financing. Instead of a bank, the seller acts as the lender. Reputable sellers who offer this are more interested in your ability to make a down payment and handle the monthly payments than they are in your credit score. It's a standard and legal way to acquire real property.

What are the risks of seller financing?

The primary risks involve unfavorable terms, such as high interest rates or clauses where the seller retains the deed until the property is fully paid off. You can mitigate nearly all these risks by working with an established, transparent company. A trustworthy seller like Dollar Land Store will provide clear, easy-to-understand contracts and have a proven track record. Always read everything carefully and ensure all terms are spelled out in writing.

Key Takeaway: The biggest risk in any land deal isn't the financing method—it's the seller. Vetting the company you buy from is just as important as inspecting the property itself.

Can I use the land immediately after buying it?

In most cases, yes. Once the contract is signed and the initial payment is made, you can typically start using your property. However, what you can do with the land—such as camping, parking an RV, or building—is determined by local county zoning regulations, not by how you financed it. That is why it's crucial to contact the county’s planning and zoning department before you buy to ensure the land is suitable for your plans.