What Is Seller Financing in Real Estate? A Guide for Land Buyers

Ross AmatoShare

Ever considered buying a piece of land without the headache of a traditional bank mortgage? Imagine finding the perfect rural parcel, agreeing on a price with the owner, and then sending your monthly payments directly to them. No banks, no underwriters, no mountains of paperwork.

That’s seller financing in a nutshell. It’s a simple, direct agreement where the person selling the land also acts as your lender. For first-time buyers and those interested in affordable raw land, this approach can be a game-changer, making land ownership more accessible and straightforward.

What is Seller Financing?

Seller financing—often called owner financing—is an alternative path to land ownership. Instead of securing a loan from a financial institution, the property owner provides the credit you need to buy their land.

This method cuts out the institutional middleman, making the entire process faster, more direct, and often more flexible. It is especially common for purchasing affordable, undeveloped land, as many traditional banks are hesitant to lend on vacant parcels.

Think of it like this: a bank loan is a three-way deal between you, the seller, and the bank. Seller financing is a two-party agreement between you and the seller. This direct relationship simplifies everything.

Seller Financing vs. Traditional Bank Loan

For a quick look at how seller financing compares to a traditional bank loan for buying land, here's a simple breakdown.

| Key Factor | Seller Financing | Traditional Bank Loan |

|---|---|---|

| Who is the Lender? | The property owner | A bank or financial institution |

| Approval Process | Simple; often no credit check | Complex; requires credit checks and underwriting |

| Down Payment | Often low and negotiable | Typically 10-20% or more |

| Closing Time | Fast, often within days | Slow, can take 30-60+ days |

| Flexibility | Highly negotiable terms | Rigid, standardized terms |

This side-by-side view highlights why many people, especially first-time land buyers, find seller financing so appealing. It puts you in greater control of the purchase process.

How Does It Work?

The beauty of this arrangement lies in its simplicity. Here are the core concepts that make it work so well for buying raw land:

- The Seller Acts as the Lender: The property owner extends you the credit to purchase their land.

- Direct Payments: You make your monthly payments directly to the seller based on the terms you both agreed upon.

- Mutually Agreed Terms: Key details like the interest rate, down payment, and loan duration are set between you and the seller, providing clarity from day one.

- A Faster Path to Ownership: Without a bank’s lengthy approval process, you can close on your property much faster and with significantly less paperwork.

This setup is ideal for anyone who might not fit a bank’s strict lending criteria, whether due to a non-traditional income or the specific type of rural land they want to buy. As you get started, it's always a good idea to know what to look for when buying land so you can make a smart choice, no matter how you finance it.

The Bottom Line: Seller financing opens doors. It clears away common roadblocks to owning property, putting the power back into the hands of buyers and sellers to create a direct path to land ownership.

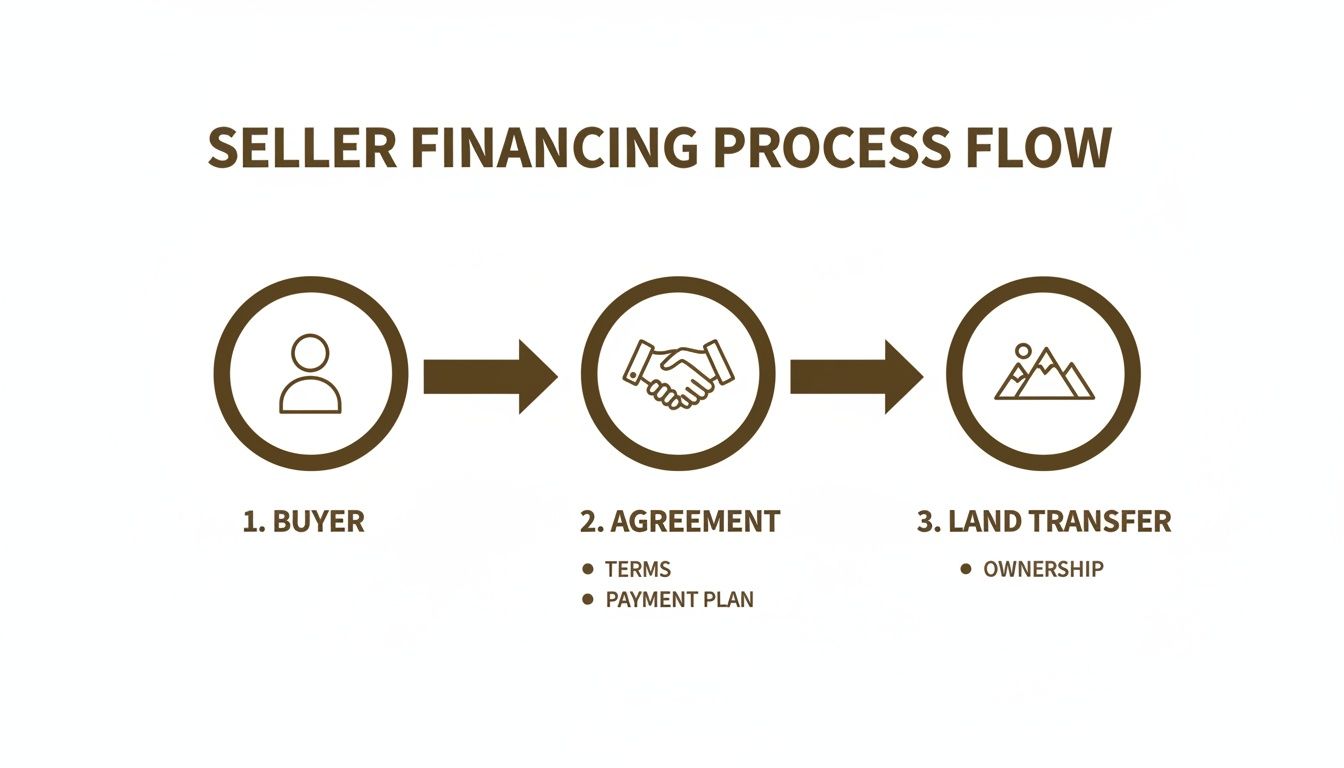

How the Seller Financing Process Works

Buying land with seller financing is far more straightforward than navigating the requirements of a traditional bank. While every seller is different, a reputable company will provide a clear, step-by-step roadmap that takes you from browsing online listings to taking possession of your new property.

Let's break down the typical stages so you know exactly what to expect.

As you can see, the process cuts out the institutional middlemen, creating a direct path between you, the seller, and the land itself.

Stage 1: Finding the Property and Agreeing on Terms

It all starts with finding a piece of land that fits your goals. With a company that specializes in seller-financed land, you can browse listings online and see all the financing terms laid out clearly.

Once you’ve selected a parcel, you’ll lock in the purchase price and financing terms. This isn’t like haggling with a mortgage broker; with a trustworthy seller, it’s a simple agreement based on transparent, pre-set terms:

- Purchase Price: The total cost of the land.

- Down Payment: The upfront amount paid to secure the property. Many sellers keep this amount low to make ownership more accessible. You can learn more about what to expect for a down payment for land here.

- Interest Rate: The percentage charged on the remaining balance you owe.

- Loan Term: How long you have to pay off the loan, usually stated in months or years.

This simple agreement is the foundation of the deal. The transparency at this stage is one of the biggest advantages of working with an experienced seller.

Stage 2: Finalizing the Legal Documents

With the terms set, the seller drafts the necessary legal documents. This is a critical step that makes the agreement official and protects both you and the seller. Properly drafting effective contracts is essential to ensure everyone is on the same page.

You'll typically encounter two key documents:

- Promissory Note: This is your legally binding promise to repay the loan on the agreed-upon schedule. It outlines the loan amount, interest rate, monthly payment, and due dates.

- Land Contract (or Contract for Deed): This document details the responsibilities of both parties. It states that the seller retains the property's legal title while you make payments. Once you’ve paid the loan in full, the seller is legally obligated to transfer the deed into your name.

It is always wise to read these documents carefully before signing. A reputable seller will provide contracts that are easy to understand, without confusing legal jargon.

Stage 3: Closing the Deal and Taking Possession

After you've signed the paperwork and made your down payment, the deal is closed. In the world of seller-financed raw land, this happens incredibly fast—often in just a few days. Compare that to the 30-60 days you might wait for a bank to finalize a traditional loan.

At this point, you can take possession of your new property and begin using it (as long as you follow local regulations and any terms in your agreement). From then on, you’ll make your regular monthly payments directly to the seller as outlined in the promissory note.

Key Takeaway: The seller financing process is built for speed and simplicity. It replaces the slow, complicated machinery of bank lending with a direct, transparent agreement between a buyer and a seller.

Pros and Cons of Seller Financing for Land Buyers

Seller financing can feel like the perfect key to unlocking land ownership, especially for a first-time buyer. While it opens many doors, it’s always smart to look at both sides of the coin. Understanding the real-world benefits and potential drawbacks helps you make a confident, informed decision.

The Advantages of Seller Financing

For anyone new to buying land, the benefits are significant. They address the most common barriers that prevent people from owning property.

- No Strict Bank Requirements: This is the most important advantage. If you're self-employed, have a limited credit history, or don't fit a bank's rigid criteria, seller financing is a powerful alternative. Your ability to make a down payment and the monthly payments is what matters most.

- Faster Closing: Without the red tape from bank underwriters, appraisers, and loan committees, the process moves much more quickly. A seller-financed deal can often be completed in a few days, not the 30-60 days banks typically require.

- Lower Upfront Costs: Traditional mortgages often include fees for loan origination, applications, and appraisals. With seller financing, most of these extra costs disappear, meaning more of your money goes directly toward your land.

- Transparent and Flexible Terms: You are dealing directly with the seller. With a straightforward company like Dollar Land Store, the terms—down payment, interest rate, and payment schedule—are laid out clearly from the start. No hidden surprises.

Key Insight: The accessibility of seller financing is its greatest strength. It creates a direct, simple, and often more affordable pathway to land ownership for a broader range of buyers.

Potential Drawbacks to Consider

Like any financial decision, it's important to be aware of potential downsides. Knowing these isn't meant to be discouraging—it’s what makes you a savvy buyer.

- Potentially Higher Interest Rates: A common trade-off for the convenience and lack of credit checks is a potentially higher interest rate compared to what a bank might offer someone with excellent credit. Sellers take on more risk, and the rate often reflects that. Always calculate the total cost over the life of the loan to ensure it fits your budget.

- Seller's Right to Foreclose: If you stop making payments and default on the agreement, the seller has the legal right to take back the property. This process can sometimes be quicker than a bank foreclosure, which highlights the importance of only committing to a payment you know you can afford.

- Possibility of a Balloon Payment: Some private seller financing deals might include a balloon payment—a large, lump-sum payment due at the end of the loan term. Reputable land companies like Dollar Land Store typically use fully amortized loans with no balloon payments, so your final payment is the same as your first. However, it is something you should always check for in any contract.

What This Means for First-Time Land Buyers

So, what does all this mean for you, the aspiring landowner? In short, it means opportunity. Seller financing is the key that unlocks the gate for many first-time buyers, transforming the dream of owning land into a tangible reality.

It works by removing institutional middlemen like banks and traditional lenders. This makes the entire process simpler, faster, and far less intimidating. You are no longer just a credit score or a loan application in a stack of paperwork. Instead, you are a person making a straightforward deal directly with the property owner. It opens the door to ownership, even if you are working with a modest budget or don't have a perfect credit history.

A Clearer Path to Ownership

The biggest advantage is how accessible it makes land ownership. Many first-time buyers are looking for affordable, rural land—exactly the type of property that traditional banks often refuse to finance. Seller financing closes that gap.

For example, you might find a perfect five-acre parcel for weekend camping, but you don't have the 20% down payment a bank would require for raw land. With seller financing, the down payment is almost always much lower. Approval is based on your ability to make that initial payment and handle the monthly ones, not a deep dive into your entire financial past.

This means you can go from browsing listings online to owning your own land with surprising speed. The focus shifts from navigating a complex financial system to simply finding a property you love and agreeing to clear, simple terms.

Gaining Confidence and Control

The feeling of empowerment that comes with this approach cannot be overstated. Instead of feeling buried in banking jargon and endless forms, you are presented with a clear, easy-to-understand contract that shows you exactly how you will own your land.

Key Takeaway: Seller financing isn't just a different way to pay for land; it's a fundamental shift that puts you in the driver's seat. It proves that with the right seller, your goal of owning land isn't a distant dream—it's an achievable goal you can act on now.

To get the full picture of the journey, our guide on how to buy rural land walks you through every step. When you combine that knowledge with the power of seller financing, you have everything you need to invest in your future with confidence.

Why Consider Dollar Land Store?

Choosing the right seller financing partner is just as important as understanding the financing method itself. At Dollar Land Store, our mission is to make land ownership straightforward, transparent, and accessible for everyone.

We are not real estate agents or brokers; we own every parcel of land we sell. This means you deal directly with us, the owner. This simple fact eliminates middlemen, agent commissions, and unnecessary complications, which helps keep your costs low and the process clear.

A Simple and Transparent Path to Owning Land

We designed our owner financing program with the needs of first-time and experienced land buyers in mind. The benefits are clear and consistent across our entire inventory.

- No Credit Checks: We believe your credit history shouldn't stand in the way of your future. Approval is guaranteed for everyone, based only on your ability to make a small down payment and the affordable monthly payments.

- Low Down Payments: With our low down payments and a single, one-time document fee, you can secure your land for a fraction of what a traditional real estate transaction would cost upfront.

- Simple, Clear Contracts: Our agreements are written in plain English. You’ll see the purchase price, interest rate, and your monthly payment laid out clearly—with no hidden fees, no balloon payments, and no surprises.

- Fast and Efficient Process: Because we handle everything in-house, we can complete the entire purchase process in just a few days. You won’t be waiting for weeks or months for a bank to give you an answer.

We are committed to being a trusted resource for anyone ready to buy rural land. We offer a large inventory of affordable raw land across several states and combine it with a financing model built for simplicity and transparency. With Dollar Land Store, your dream of owning land is much closer than you think.

Your Next Steps to Owning Land

Now that you understand how seller financing works, it’s time to put that knowledge to use. Your path to owning a piece of land can start right now with a few simple, practical actions.

The best way to grasp the power of owner financing is to see it in action. By looking at actual properties for sale, you can see exactly how the terms, down payments, and monthly costs come together to make land ownership surprisingly affordable.

Explore and Evaluate Available Properties

Start by browsing available land parcels. This is the exciting part, where the idea of owning land becomes real and you can start to visualize what’s possible.

As you look through different properties, keep an eye on the details that matter in a seller-financed deal:

- Review the Financial Terms: Look at the total price, the required down payment, and the monthly payment amount. A transparent seller like Dollar Land Store lays these details out clearly on every listing, so you know exactly what to expect.

- Check Property Details: Pay close attention to the acreage, legal access, zoning information, and property taxes. Does the parcel fit your long-term goals, whether for recreation, investment, or eventually building?

- Ask Questions: Never hesitate to reach out if something is unclear. A trustworthy seller will be happy to answer your questions about the property or the financing process, ensuring you feel completely comfortable before moving forward.

Taking the time to browse listings and ask questions is the most empowering part of the land buying journey. It equips you with the practical knowledge needed to spot the right opportunity.

Ready to see what's out there? Explore seller-financed land options through Dollar Land Store and take that exciting next step toward becoming a landowner.

Answering Your Questions About Seller Financing

It’s natural to have questions when exploring a new way to buy land. Here are answers to some of the most common inquiries we receive from first-time buyers.

Can I Pay Off My Seller-Financed Land Loan Early Without a Penalty?

Absolutely. With a reputable seller like Dollar Land Store, there are no prepayment penalties. This is a significant advantage, as it gives you the freedom to pay off your property on your own schedule without incurring extra fees. Whether you stick to the monthly plan or decide to pay it off faster, you are in complete control.

What Happens If I Miss a Payment on a Seller-Financed Property?

Communication is key. If you anticipate missing a payment, the best first step is to contact the seller and explain the situation. Most sellers would rather work out a solution with you than reclaim the property. However, the seller does have the legal right to take back the land if you default on the contract. This process, whether called foreclosure or forfeiture, will be clearly outlined in your agreement.

Are Property Taxes Included in My Monthly Payment?

Typically, no. Your monthly payment to the seller covers the principal and interest on the loan for the land itself. You will be responsible for paying the annual property taxes directly to the county, just as you would if you bought the property with cash or a bank loan. It's important to factor this recurring cost into your overall budget.

Do I Need a Lawyer to Review the Seller Financing Contract?

While companies like Dollar Land Store use standardized contracts designed to be simple and easy to understand, you always have the right to have an attorney review any legal document before you sign it. Many buyers find the clarity of our agreements makes this step feel unnecessary, but it is a personal choice. If it provides you with extra peace of mind, a transparent seller will always support your decision to seek legal advice.

Conclusion

Seller financing demystifies the land buying process, offering a clear, accessible, and efficient alternative to traditional bank loans. By removing institutional barriers, it empowers more people—especially first-time buyers—to achieve their goal of owning a piece of land. With transparent terms, low down payments, and a direct relationship with the seller, you can move forward with confidence. The path to land ownership is more straightforward than you might think, and seller financing is often the key to getting started.

Ready to see how simple owning land can be?

Browse available land at DollarLandStore.com