Owner Financed Land for Sale: A Simple Way to Buy Land Without a Bank

Ross AmatoShare

For many people dreaming of owning land, the biggest roadblock isn't finding the perfect parcel—it's getting a loan from a bank. Traditional lenders are often hesitant to finance raw land, creating high barriers for first-time buyers. This is where owner financed land for sale emerges as a practical and accessible alternative.

The concept is simple: instead of dealing with a bank, you purchase the land directly from the seller, making monthly payments to them. This approach, also known as seller financing, cuts out the middlemen and makes land ownership possible for a much wider range of buyers, especially those looking for rural or recreational properties. It’s an ideal solution for buyers who value a straightforward process, have been turned down by banks, or are looking to build their assets without a perfect credit history.

What Is Owner Financed Land?

Owner-financed land is a property you buy directly from the owner, who acts as your lender. You and the seller agree on a purchase price, a down payment, monthly payments, and the loan term. You then make your payments to the seller until the land is paid off, at which point the legal title is transferred to your name.

This method differs significantly from traditional bank financing. Banks often view vacant land as a risky investment because there is no house on it to serve as primary collateral. As a result, they typically require large down payments (often 20% or more), excellent credit scores, and a lengthy, complicated approval process. For many buyers, these requirements make getting a conventional land loan nearly impossible.

Owner financing bypasses these hurdles entirely. It creates a direct, simple, and often more flexible arrangement between the buyer and the seller, making it a popular choice for acquiring undeveloped, rural, and off-grid land.

How Owner Financing for Land Works

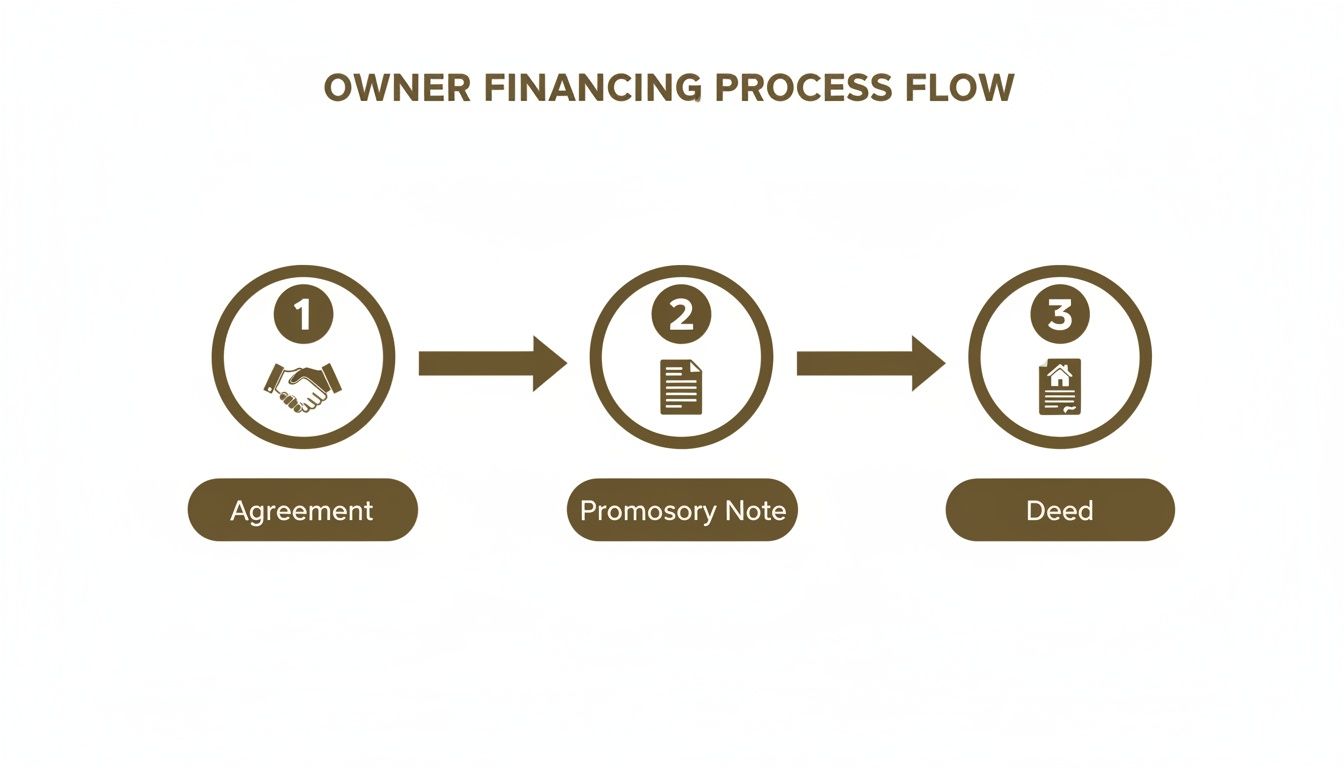

The process of buying owner-financed land is designed to be clear and straightforward. While specific terms can vary from one seller to another, the core steps remain consistent and are outlined in a legally binding contract.

Here’s a step-by-step breakdown of a typical owner financing agreement:

- Purchase Price: This is the total agreed-upon cost of the land. It’s the starting point for all other calculations.

- Down Payment: Unlike the hefty down payments required by banks, owner financing often involves a very low initial payment. This makes getting started much more affordable.

- Monthly Payments: Once the down payment is subtracted from the purchase price, the remaining balance is divided into predictable monthly payments spread out over the loan term.

- Interest: The seller may charge interest on the financed amount. This rate is clearly stated in your contract, so you know exactly how much you'll pay over the life of the loan.

- Length of Term: This is the duration of the loan, typically expressed in months or years. A common term for land might be anywhere from 5 to 10 years (60 to 120 months).

- When Title Transfers: While you make payments, you typically hold "equitable title," which gives you the right to use and enjoy the land. The seller retains "legal title" as security. Once you make the final payment, the seller signs the deed over to you, and the legal title is officially recorded in your name. You then own the property free and clear.

Benefits of Buying Owner Financed Land

Choosing owner financing provides several key advantages, especially for first-time land buyers or those who don't fit the rigid profile required by traditional lenders.

- No Bank Approval Needed: You skip the entire bank underwriting process, which can be slow and invasive.

- No Traditional Credit Check: Most sellers offering this option focus on your ability to make payments, not your past credit score. This opens the door to ownership for many who might otherwise be disqualified.

- Faster Closing: Without bank bureaucracy, the transaction can be completed in days instead of weeks or months.

- Flexible Terms: While terms are set, the direct relationship with the seller can sometimes allow for more practical arrangements than a large financial institution would offer.

- Predictable Monthly Payments: Your payments are typically fixed for the life of the loan, making it easy to budget.

- Works Well for Rural and Recreational Land: It’s an ideal financing method for the types of raw land that banks are most reluctant to fund.

Things Buyers Should Understand Before Purchasing

Owner financing offers incredible accessibility, but this convenience comes with the responsibility of performing your own due diligence. This step is critical for ensuring the property meets your needs and that there are no surprises down the road.

As the buyer, you are responsible for:

- Verifying Zoning, Access, and Allowed Use: Always contact the county's Planning and Zoning department before purchasing. Confirm what you can legally do on the property, such as camping, building, or parking an RV. Also, verify that the property has legal, recorded access.

- Understanding Property Taxes: You will be responsible for paying annual property taxes. You can find out the approximate annual cost by checking the county treasurer or assessor's website.

- Knowing About "As-Is" Sales: Vacant land is typically sold "as-is," meaning the seller makes no warranties about its condition or suitability for a specific purpose. Your research is your best tool.

- No Refunds: Once the contracts are signed and the purchase is complete, land sales are generally final. Be certain about your decision before you commit.

Taking ownership of these research tasks is what makes a buyer successful and confident. For more details on this process, see our guide on how to purchase raw land.

Who Is Owner Financed Land Best For?

Owner financing is an excellent option for a wide variety of buyers who find traditional lending impractical or inaccessible. It is particularly well-suited for:

- Buyers Rebuilding Credit: Since there is often no credit check, it provides a path to property ownership while you improve your financial standing.

- Cash-Conscious Buyers: Low down payments make it possible to buy land without saving up a huge lump sum.

- Off-Grid or Recreational Land Buyers: It’s a perfect fit for purchasing affordable land for camping, hunting, or building a remote cabin.

- Long-Term Investors: Seller financing allows you to acquire a tangible asset with minimal upfront investment and predictable carrying costs.

- First-Time Landowners: The simple, transparent process demystifies real estate and makes it less intimidating for beginners.

Common Myths About Owner Financed Land

Several misconceptions about owner financing persist, but a clear understanding reveals it to be a secure and legitimate transaction method. Let's address them with facts.

-

Myth: “It’s a scam.”

Fact: Owner financing is a long-established, legal method of selling real estate, governed by written contracts. Working with a reputable company with a long history of transactions ensures a legitimate process. -

Myth: “You don’t really own it.”

Fact: While making payments, you hold "equitable title," granting you the right to use and control the land. This is a recognized form of ownership interest. Upon final payment, you receive the full legal title via a deed. -

Myth: “Interest is always high.”

Fact: While interest rates may sometimes be higher than a bank's prime rate, they compensate for the seller taking on risk without a credit check and offering accessible terms. When you factor in the absence of closing costs and the speed of the transaction, the overall value is often excellent. -

Myth: “There are hidden fees.”

Fact: A transparent seller will disclose all costs upfront in the purchase agreement. This typically includes the price, a one-time document processing fee, and any applicable loan servicing fees or late fees. There should be no surprises.

How to Find Legitimate Owner Financed Land for Sale

Finding a trustworthy seller is the most important step in your search. A legitimate company will operate with transparency and professionalism.

Here are some best practices to follow and red flags to avoid:

- Look for Written Contracts: Never proceed without a clear, comprehensive written agreement that details all terms of the sale.

- Verify Seller Ownership: A reputable seller will have clear title to the property they are selling. You can often verify ownership records through the county.

- Seek Out Clear Payment Systems: Professional sellers use online payment portals or third-party loan servicing companies to track payments accurately.

- Demand Transparent Terms: The purchase price, down payment, monthly payment, interest rate, and any fees should be clearly stated before you sign anything.

- Avoid High-Pressure Tactics: A credible seller wants you to be informed and confident in your purchase, not rushed into a decision.

These practices not only protect you but are also hallmarks of how a professional land company like Dollar Land Store operates. To learn more about the structure of these deals, our guide explaining what seller financing is in real estate is a great resource.

Why Consider Dollar Land Store?

When searching for owner financed land for sale, the seller you choose matters just as much as the property itself. Dollar Land Store was founded on the principles of making land ownership simple, transparent, and accessible to everyone. We specialize in selling affordable, undeveloped rural land through a straightforward owner-financing process.

Our approach is built to remove the barriers that stop most buyers:

- Affordable Land with Low Payments: We make it easy to get started. Many of our properties can be secured with a low down payment and a one-time document fee, followed by affordable monthly payments.

- Simple Owner Financing with No Credit Checks: We believe your financial past shouldn't prevent you from building your future. We never run credit checks, and everyone is approved.

- Transparent Terms: Every detail of your purchase is outlined in clear, easy-to-understand contracts. There are no hidden fees or surprises.

- Fast Contract Setup: Our process is streamlined and can be completed entirely online, allowing you to secure your property in just a few days.

- Broad Inventory Across Several States: We offer a wide selection of raw land in states like Arizona, Colorado, Nevada, Oregon, and more.

- No Middlemen or Real Estate Agents: As the direct seller, we eliminate commissions and complicated negotiations, passing the simplicity and savings on to you.

We are not a traditional real estate agency; we are a dedicated team with expertise in the rural land market, committed to helping first-time buyers achieve their goal of land ownership.

Your Next Steps to Land Ownership

Now that you understand how owner financing works, you can take the next step with confidence. This method is a legitimate and practical path to owning a real asset. By focusing on education, performing thorough due diligence, and setting realistic expectations, you can make a smart investment in your future.

Ready to begin your journey?

- Browse available parcels on our website to see what's available.

- Learn more about our seller financing to understand the process inside and out.

- Contact DLS with your questions—our team is here to provide clear answers without any pressure.

Conclusion

Owner-financed land for sale provides a powerful alternative to the complexities and restrictions of traditional bank loans. It levels the playing field, allowing anyone with a steady ability to pay to invest in their own piece of land. By prioritizing accessibility, transparency, and a simple process, sellers create opportunities for buyers to achieve their dreams of ownership, whether for recreation, investment, or a future off-grid homestead.

The key to success is pairing this accessible financing with your own diligent research. When you work with a trusted seller and verify all property details with the county, you position yourself to make a sound and rewarding purchase.

At Dollar Land Store, our goal is to make land ownership a clear and achievable dream. Browse our owner-financed land listings today and see for yourself how simple the path to owning land can be.